IHOP 2010 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

20. Income Taxes (Continued)

Kansas. The HPIP credits available for carry back and carry forward are approximately $3.2 million and

will expire, if unused, during the period from 2016 through 2019.

For the years ended December 31, 2010 and 2009, the Company had a total valuation allowance in

the amounts of $9.6 million and $9.8 million, respectively. Of the total $9.6 million in 2010, $7.0 million

is related to a change in the enacted tax law for the state of Michigan, $1.2 million is related to the

Massachusetts enacted legislation requiring unitary businesses to file combined reports and $1.4 million

is related to the HPIP credits associated with the Applebee’s Restaurant Support Center in Lenexa,

Kansas.

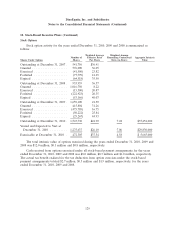

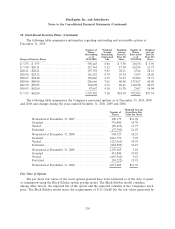

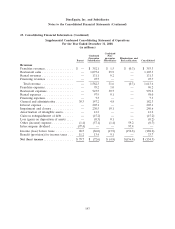

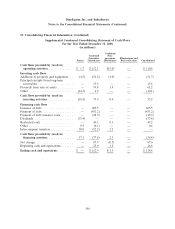

21. Net Income (Loss) Per Share

The computation of the Company’s basic and diluted net income (loss) per share is as follows:

Year Ended December 31,

2010 2009 2008

(In thousands, except per share data)

Numerator for basic and diluted income (loss) per common share:

Net income (loss) ...................................... $ (2,788) $ 31,409 $(154,459)

Less: Series A preferred stock dividends .................... (25,927) (19,531) (19,000)

Less: Accretion of Series B preferred stock .................. (2,432) (2,291) (2,151)

Less: Net (income) loss allocated to unvested participating

restricted stock .................................... 1,173 (351) 6,417

Net income (loss) available to common stockholders ............. $(29,974) $ 9,236 $(169,193)

Denominator:

Weighted average outstanding shares of common stock ........... 17,240 16,917 16,764

Dilutive effect of:

Common stock equivalents .............................. — — —

Common stock and common stock equivalents ................. 17,240 16,917 16,764

Net (loss) income per common share:

Basic ............................................. $ (1.74) $ 0.55 $ (10.09)

Diluted ............................................ $ (1.74) $ 0.55 $ (10.09)

For the years ended December 31, 2010, 2009 and 2008, diluted loss per common share is

computed using the weighted average number of common shares outstanding during the period, as the

992,600, 848,000 and 756,000 shares, respectively, from common stock equivalents would have been

antidilutive.

136