IHOP 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

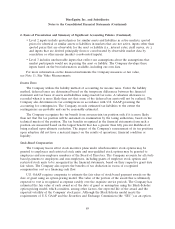

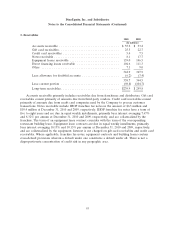

7. Other Intangible Assets (Continued)

Gross and net carrying amounts of intangible assets subject to amortization at December 31, 2010

and 2009 are as follows:

December 31, 20010 December 31, 2009

Accumulated Accumulated

Gross Amortization Net Gross Amortization Net

(In millions)

Franchising rights . . $200.4 $(31.1) $169.3 $200.5 $(21.0) $179.5

Recipes and menus . 15.7 (6.8) 8.9 15.7 (4.5) 11.2

Leaseholds/other . . . 5.6 (3.2) 2.4 6.2 (2.8) 3.4

Total ............. $221.7 $(41.1) $180.6 $222.4 $(28.3) $194.1

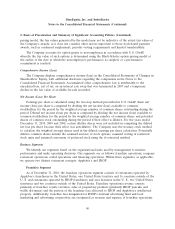

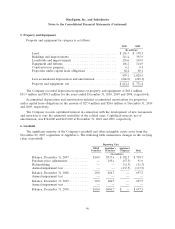

8. Debt

Debt consists of the following components:

2010 2009

(In millions)

Senior Secured Credit Facility, due October 2017, at a variable interest rate of

6.0% as of December 31, 2010 .................................... $ 844.0 $ —

Senior Notes due October 2018, at a fixed rate of 9.5% .................... 825.0 —

Series 2007-1 Class A-2-II-A Fixed Rate Term Senior Notes due December 2037,

at a fixed rate of 7.1767% (inclusive of an insurance premium of 0.75%) ..... — 599.1

Series 2007-1 Class A-2-II-X Fixed Rate Term Senior Notes due December 2037,

at a fixed rate of 7.0588% ....................................... — 434.2

Series 2007-1 Class M-1 Fixed Rate Term Subordinated Notes due December

2037, at a fixed rate of 8.4044% ................................... — 104.0

Series 2007-1 Class A-1 Variable Funding Senior Notes, final maturity date

December 2037, at a rate of 2.89% as of December 31, 2009 .............. — 100.0

Series 2007-1 Fixed Rate Notes due March 2037, at a fixed rate of 5.744%

(inclusive of an insurance premium of 0.60%) ......................... — 175.0

Series 2007-2 Variable Funding Notes, final maturity date March 2037, at a rate of

0.3% as of December 31, 2009 .................................... — 25.0

Series 2007-3 Fixed Rate Term Notes due December 2037, at a fixed rate of

7.0588% .................................................... — 245.0

Discount ...................................................... (28.5) (19.9)

Total debt ..................................................... 1,640.5 1,662.4

Less current maturities ........................................... (9.0) (25.2)

Long-term debt ................................................. $1,631.5 $1,637.2

Long-Term Debt Instruments Outstanding

In October 2010, the Company effected a series of transactions that culminated in the retirement

of all long-term debt instruments that had been outstanding at December 31, 2009 and the release from

99