IHOP 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

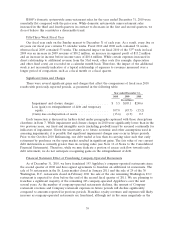

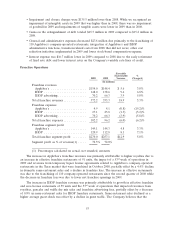

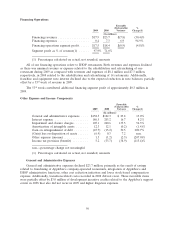

Financing Operations

Favorable

(Unfavorable) %

2010 2009 Variance Change(1)

(In millions)

Financing revenues .................. $16.2 $17.9 $(1.7) (9.2)%

Financing expenses .................. 2.0 0.4 (1.6) (431.9)%

Financing operations segment profit ...... $14.2 $17.5 $(3.3) (18.5)%

Segment profit as % of revenue(1) ...... 87.9% 97.9%

(1) Percentages calculated on actual, not rounded, amounts

All of our financing operations relate to IHOP restaurants. Financing revenues were lower due to

a decline in franchise and equipment note interest as note balances decline and the impact of the

53rd week in 2009, partially offset by an increase in revenue from resale of rehabilitated franchise

restaurants. Financing expenses were higher due to an increase in the cost associated with resale of

rehabilitated franchise restaurants.

The 53rd week contributed additional financing segment profit of approximately $0.3 million in

2009.

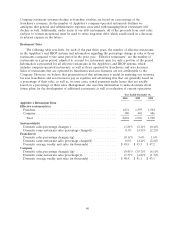

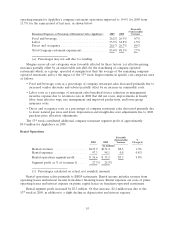

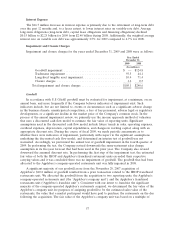

Other Expense and Income Components

Favorable

(Unfavorable) %

2010 2009 Variance Change(1)

(In millions)

General and administrative expenses .... $159.7 $158.5 $ (1.2) (0.6)%

Interest expense ................... 171.5 186.5 15.0 8.0%

Impairment and closure charges ........ 3.5 105.1 101.6 96.7%

Amortization of intangible assets ....... 12.3 12.3 — —

Loss (gain) on extinguishment of debt and

temporary equity ................. 107.0 (45.7) (152.7) (334.1)%

Gain on disposition of assets .......... (13.6) (6.9) 6.7 95.4%

Other expense (income) .............. 3.6 1.3 (2.3) (183.1)%

Income tax (benefit) provision ......... (9.3) 5.2 14.5 279.6%

(1) Percentages calculated on actual, not rounded, amounts

General and Administrative Expenses

General and administrative expenses increased $1.2 million, primarily due to an increase in stock-

based compensation expenses, higher salaries and benefits, higher travel costs and higher recruiting and

relocation costs. Stock-based compensation costs increased primarily due to the acceleration of

expenses due to changes resulting from vesting of certain equity grants to directors and the retirement

of an executive and the impact of a higher stock price on equity grants accounted for as liabilities. The

increase in salaries and benefits is primarily due to an increase in managers and related training costs

and the filling of open positions at Applebee’s. The increase in recruiting costs was primarily due to the

hiring of more executive level positions in 2010.

48