IHOP 2010 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

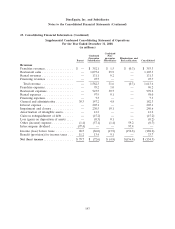

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

20. Income Taxes (Continued)

Internal Revenue Service for the period ended November 29, 2007. The Company is currently under

audit by the United States Internal Revenue Service for the period ended December 30, 2007.

At December 31, 2010, the Company had a liability for unrecognized tax benefit including

potential interest and penalties, net of related tax benefit, totaling $13.9 million, of which approximately

$1.7 million is expected to be paid within one year. For the remaining liability, due to the uncertainties

related to these tax matters, the Company is unable to make a reasonably reliable estimate when a cash

settlement with a taxing authority will occur.

The total unrecognized tax benefit as of December 31, 2010 and 2009 was $12.8 million and

$11.0 million, respectively, excluding interest, penalties and related income tax benefits. The increase of

$1.8 million is primarily related to reserves for goodwill intangibles, partially offset by settlements with

taxing authorities resulting in a decrease in unrecognized tax benefits related to prior year positions.

The entire $12.8 million will be included in the Company’s effective income tax rate if recognized. The

Company estimates the unrecognized tax benefits may decrease over the upcoming 12 months by an

amount up to $2.2 million related to settlements with taxing authorities and the lapse of the statute of

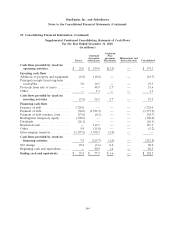

limitations. A reconciliation of the beginning and ending amount of unrecognized tax benefits is as

follows:

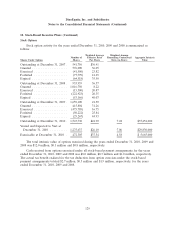

(in millions)

Unrecognized tax benefit as of December 31, 2008 ................ $18.6

Change as a result of prior year tax positions .................... 0.6

Change as a result of current year tax positions ................... —

Decreases relating to settlements with taxing authorities ............ (7.2)

Decreases as a result of a lapse of the statute of limitations .......... (1.0)

Unrecognized tax benefit as of December 31, 2009 ................ 11.0

Change as a result of prior year tax positions .................... 7.7

Change as a result of current year tax positions ................... —

Decreases relating to settlements with taxing authorities ............ (5.6)

Decreases as a result of a lapse of the statute of limitations .......... (0.3)

Unrecognized tax benefit as of December 31, 2010 ................ $12.8

As of December 31, 2010, the accrued interest and penalties were $8.9 million and $0.5 million,

respectively, excluding any related income tax benefits. As of December 31, 2009, the accrued interest

and penalties were $11.6 million and $1.6 million, respectively, excluding any related income tax

benefits. The decrease of $2.7 million of accrued interest is primarily related to the decrease of

unrecognized tax benefits due to settlements with taxing authorities, partially offset by the accrual of

interest during the twelve months ended December 31, 2010. The Company recognizes interest accrued

related to unrecognized tax benefits and penalties as a component of income tax expense which is

recognized in the Consolidated Statements of Operations.

The Company has various state net operating loss carryovers representing $2.1 million of state

taxes. The net operating loss carryovers will expire, if unused, during the period from 2011 through

2028. In 2009, the Company completed the certification process for High Performance Incentive

Program (‘‘HPIP’’) credits associated with the Applebee’s Restaurant Support Center in Lenexa,

135