IHOP 2010 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

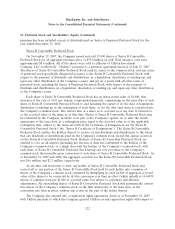

17. Impairments and Closure Charges

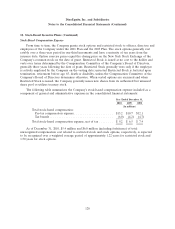

Impairment and closure charges for the years ended December 31, 2010, 2009 and 2008 were as

follows:

Year Ended December 31,

2010 2009 2008

(In millions)

Goodwill impairment ........................... $— $ — $124.8

Tradename impairment .......................... — 93.5 44.1

Long-lived tangible asset impairment ................ 2.0 10.4 71.4

Closure charges ............................... 1.5 1.2 0.3

Total impairment and closure charges ................. $3.5 $105.1 $240.6

Goodwill Impairment

In accordance with U.S GAAP, goodwill must be evaluated for impairment, at a minimum, on an

annual basis, and more frequently if the Company believes indicators of impairment exist. Such

indicators include, but are not limited to, events or circumstances such as a significant adverse change

in the business climate, unanticipated competition, a loss of key personnel, adverse legal or regulatory

developments, or a significant decline in the market price of our common stock. In the process of the

annual impairment review, the Company primarily uses the income approach method of valuation that

uses a discounted cash flow model to estimate the fair value of reporting units. Significant assumptions

used in the discounted cash flow model include future trends in sales, operating expenses, overhead

expenses, depreciation, capital expenditures, and changes in working capital, along with an appropriate

discount rate. During the course of fiscal 2010, 2009 and 2008 the Company made periodic assessments

as to whether there were indicators of impairment, particularly with respect to the significant

assumptions underlying the discounted cash flow model. In each year the Company determined an

interim test of goodwill was not warranted. Accordingly, the Company performed the annual test of

goodwill impairment in the fourth quarter of 2010, 2009 and 2008. The impairment test of goodwill of

the Applebee’s company-operated restaurants unit (‘‘Applebee’s company unit’’) and Applebee’s

franchised restaurants unit (‘‘Applebee’s franchise unit’’), which hold the significant majority of the total

goodwill, was performed as of October 31 of each year. The impairment test of the goodwill of the

IHOP franchised restaurants unit (‘‘IHOP unit’’) was performed as of December 31 of each year, the

date as of which the analysis has been performed in prior years.

In performing the first step of the impairment test, the estimated fair value of both the IHOP and

Applebee’s franchised restaurant units exceeded their respective carrying values and the Company

concluded there was no impairment of goodwill in either 2010 or 2009. In the 2008, the Company

concluded the fair the IHOP unit and the Applebee’s franchise unit was in excess of their respective

net carrying values and no impairment of goodwill was warranted. However, the fair value of the

Applebee’s company unit was less than the net carrying value of its assets assigned, requiring the

second step of the impairment test. In performing the second step of the impairment test the Company

concluded that the goodwill allocated to the Applebee’s company unit was fully impaired and an

impairment charge of $113.5 million was recorded. No tax benefit is associated with the impairment of

goodwill. During the fourth quarter of 2008 the commercial real estate market continued to weaken,

the credit markets continued constrained, economic forecasts were uncertain as to how long the

recessionary period would last, and the Company’s stock price declined. The Company revised the

124