IHOP 2010 Annual Report Download - page 90

Download and view the complete annual report

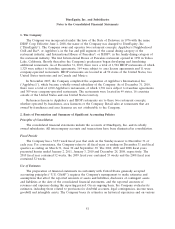

Please find page 90 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.New Accounting Pronouncements

ASU 2010-06 also requires that disclosures about purchase, sale, issuance, and settlement activity

related to assets and liabilities whose fair value is measured using Level 3 inputs be presented on a

gross basis rather than as a net number as currently permitted. This provision of this ASU will be

effective for the Company’s reporting period ending March 31, 2011. As this provision amends only the

disclosure requirements for fair value measurements, the adoption will have no impact on the

Company’s balance sheets, statements of operations or statements of cash flows.

In July 2010, the FASB issued ASU 2010-20, ‘‘Disclosures about the Credit Quality of Financing

Receivables and the Allowance for Credit Losses.’’ This ASU amends disclosure requirements with

respect to the credit quality of financing receivables and the related allowance for credit losses. Entities

will be required to disaggregate by portfolio segment or class certain existing disclosures and provide

certain new disclosures about its financing receivables and related allowance for credit losses.

Disclosures to be made as of the end of a reporting period will be effective for the Company’s

reporting period ending December 31, 2010; the disclosures about activity that occurs during a

reporting period will be effective for the Company’s reporting period ending March 31, 2011. Since this

ASU will only amended disclosure requirements, not current accounting practice, adoption of this ASU

with respect to end-of-reporting period disclosures did not have any impact on the Company’s balance

sheets, statements of operations or statements of cash flows.

The Company reviewed all other significant newly issued accounting pronouncements and

concluded that they either are not applicable to the Company’s operations or that no material effect is

expected on the Company’s financial statements as a result of future adoption

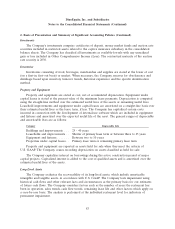

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

We are exposed to financial market risk, including interest rates and commodity prices. We address

these risks through controlled risk management that may include the use of derivative financial

instruments to economically hedge or reduce these exposures. We do not enter into financial

instruments for trading or speculative purposes.

Interest Rate Risk

Our interest income and expense is more sensitive to fluctuations in the general level of United

States interest rates than to changes in rates in other markets. Changes in the United States Treasury-

based interest rates affect the interest earned on our cash and cash equivalents, restricted cash and

investments, and interest expense on our Senior Secured Credit Facility. Our future investment income

and interest expense may differ from expectations due to changes in interest rates.

Investments in fixed-interest-rate-earning instruments carry a degree of interest rate risk. Fixed

rate securities may have their fair market value adversely impacted due to a rise in interest rates. We

currently do not hold any fixed rate investments. As of December 31, 2010 our long-term investments

are comprised primarily of certificates of deposits, mutual funds invested in auction rate securities and

one auction rate security; these investments are included in restricted assets related to the captive

insurance subsidiary. We have classified these investments as available-for-sale. Due to the short time

period between reset dates of the interest rates, there are no unrealized gains or losses associated with

interest rate related to the auction rate securities. The one auction rate security has a contractual

maturity of December 2030. Based on our cash and cash equivalents, restricted cash and long-term

restricted investment holdings as of December 31, 2010, a 1% increase in interest rates would increase

our annual interest income by approximately $0.7 million. A 1% decline in interest rates would

decrease our annual interest income by less than $0.7 million as the majority of our cash and cash

equivalents, restricted cash and long-term investment holdings are currently yielding less than 1%.

74