IHOP 2010 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

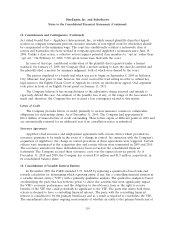

11. Fair Value Measurements (Continued)

Financial instruments measured at fair value on a recurring basis at December 31, 2010 and 2009

are as follows:

Fair Value Measured Using

Fair Value Level 1 Level 2 Level 3

(In millions)

At December 31, 2010:

Restricted assets of captive insurance company $3.6 $1.0 $— $2.6

Loan guarantees ...................... $0.2 $ — $— $0.2

At December 31, 2009:

Restricted assets of captive insurance company $4.3 $1.7 $— $2.6

Loan guarantees ...................... $0.3 $ — $— $0.3

The level 3 inputs used for the restricted assets consist of a discounted cash flow under the income

approach using primarily assumptions as to future interest payments and a discount rate. The fair value

of the guarantees was determined by assessing the financial health of each of the four franchisees that

have open notes and assessing the likelihood of default. There was no change in the valuation

methodologies between the years presented.

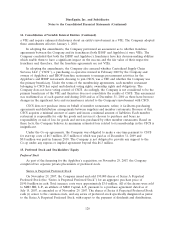

12. Fair Value of Financial Instruments

The Company believes the fair values of cash equivalents, accounts receivable, accounts payable

and the current portion of long-term debt approximate their carrying amounts due to their short

duration.

The following table summarizes cost and market value of our financial instruments measured at

fair value (see Note 11, Fair Value Measurements) at December 31, 2010:

Gross Gross

Unrealized Unrealized

Cost Gains Losses Fair Value

(in millions)

Cash equivalents and money market funds . . $1.0 $— $ — $1.0

Auction-rate securities ................. $2.9 $— $(0.3) $2.6

There were no sales or purchases of auction-rate securities for the year ended December 31, 2010.

The scheduled maturity of the auction-rate security is December, 2030.

The fair values of non-current financial liabilities are shown in the following table:

December 31, 2010 December 31, 2009

Carrying Carrying

Amount Fair Value Amount Fair Value

(in millions)

Long-term debt, less current maturities . . $1,631.5 $1,721.0 $1,637.2 $1,547.5

Series A Preferred Stock ............. $ — $ — $ 187.1 $ 168.3

117