IHOP 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases

of Equity Securities.

Market Information

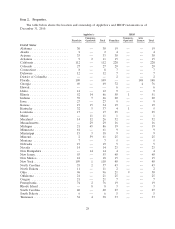

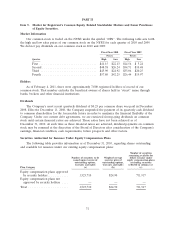

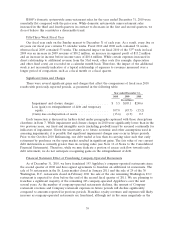

Our common stock is traded on the NYSE under the symbol ‘‘DIN’’. The following table sets forth

the high and low sales prices of our common stock on the NYSE for each quarter of 2010 and 2009.

We did not pay dividends on our common stock in 2010 and 2009.

Fiscal Year 2010 Fiscal Year 2009

Prices Prices

Quarter High Low High Low

First ................................. $41.15 $22.13 $14.56 $ 5.24

Second ............................... $48.38 $26.24 $34.71 $10.48

Third ................................ $45.90 $24.92 $33.06 $20.25

Fourth ............................... $57.80 $42.25 $26.44 $19.97

Holders

As of February 4, 2011, there were approximately 7,000 registered holders of record of our

common stock. That number excludes the beneficial owners of shares held in ‘‘street’’ name through

banks, brokers and other financial institutions.

Dividends

The Company’s most recent quarterly dividend of $0.25 per common share was paid in December

2008. Effective December 11, 2008, the Company suspended the payment of its quarterly cash dividend

to common shareholders for the foreseeable future in order to maximize the financial flexibility of the

Company. Under our current debt agreements, we are restricted from paying dividends on common

stock until certain financial ratios are achieved. Those ratios have not been achieved as of

December 31, 2010. At such time as those financial ratios are achieved, dividend payments on common

stock may be resumed at the discretion of the Board of Directors after consideration of the Company’s

earnings, financial condition, cash requirements, future prospects and other factors.

Securities Authorized for Issuance Under Equity Compensation Plans

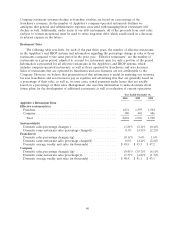

The following table provides information as of December 31, 2010, regarding shares outstanding

and available for issuance under our existing equity compensation plans:

Number of securities

remaining available for

Number of securities to be Weighted average future issuance under

issued upon exercise of exercise price of equity compensation plans

outstanding options, outstanding options, (excluding securities

warrants and rights warrants and rights reflected in column (a))

Plan Category (a) (b) (c)

Equity compensation plans approved

by security holders ............ 1,523,710 $24.90 711,917

Equity compensation plans not

approved by security holders .... — — —

Total ....................... 1,523,710 $24.90 711,917

31