IHOP 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

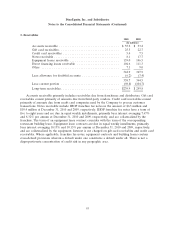

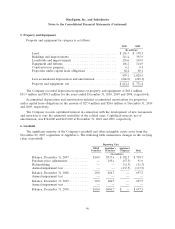

4. Assets Held For Sale (Continued)

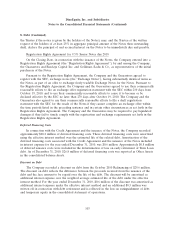

The following table summarizes the changes in the balance of assets held for sale during fiscal

2010:

(In millions)

Balance December 31, 2009 ................................. $ 8.8

Assets transferred to held for sale ............................ 63.8

Assets sold ............................................. (33.7)

Assets refranchised ....................................... (0.5)

Other ................................................. (0.5)

Balance December 31, 2010 ................................. $37.9

During the twelve months ended December 31, 2010, the Company entered into asset purchase

agreements for the sale of 149 company-operated Applebee’s restaurants, 63 located in Minnesota and

parts of Wisconsin, 36 in the St. Louis market area of Missouri, 30 in the Washington, D.C. area and

20 in Roanoke and Lynchburg in the State of Virginia. Accordingly, $58.0 million, representing the net

book value of the assets related to these restaurants, was transferred to assets held for sale.

Additionally, $5.5 million was transferred to assets held for sale related to parcels of land on which

three of the 149 restaurants being sold are situated. These parcels were not part of the asset purchase

agreement but are being actively marketed. Additionally, $0.3 million related to one IHOP franchise

restaurant held for refranchising was classified as held for sale.

Assets sold of $33.7 million comprised the 83 restaurants from the Minnesota/Wisconsin and

Roanoke/Lynchburg markets, four parcels of land on which Applebee’s franchised restaurants are

situated, the Applebee’s restaurant and property and equipment held for sale at December 31, 2009

and one parcel of land previously intended for future restaurant development.. The IHOP restaurant

held for sale at December 31, 2009 was refranchised. The balance of assets held for sale at

December 31, 2010 of $37.9 million was primarily comprised of assets of the 36 restaurants in the

St. Louis market area of Missouri, 30 restaurants in the Washington, D.C. area, three parcels of land

on which Applebee’s franchised restaurants are situated, three parcels of land previously intended for

future restaurant development and one IHOP restaurant held for refranchising.

All assets reported as held for sale are part of the company restaurant operations segment.

95