IHOP 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

company-operated restaurant, a write-down to the estimated sales value based on a current letter of

intent of one Applebee’s restaurant that had been closed in a prior period and included in assets held

for sale as of December 31, 2008 and four parcels of Applebee’s real estate. We had fee ownership of

the properties on which four Applebee’s company-operated restaurants were located. These restaurants

were franchised in the fourth quarter of 2008 but we retained ownership of the land and continued to

lease the property to the franchisee. Our strategy does not contemplate retaining such properties as a

lessor on a long-term basis. During the third quarter of 2009, we determined the properties met the

requirements under U.S. GAAP to be reclassified as assets held for sale. The properties were written

down to the estimated fair value that will be received upon sale. We evaluated the causal factors of all

impairments of long-lived assets as they were recorded during 2010 and 2009 and concluded they were

based on factors specific to each asset and were not potential indicators of an impairment of goodwill,

indefinite-lived intangible assets or other long-lived assets. Closure costs of $1.2 million related to two

IHOP franchise restaurants.

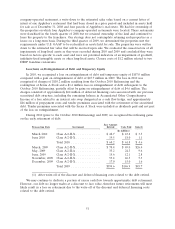

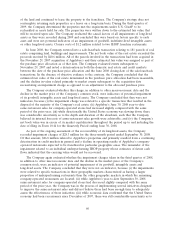

Loss/Gain on Extinguishment of Debt and Temporary Equity

In 2010, we recognized a loss on extinguishment of debt and temporary equity of $107.0 million

compared with a gain on extinguishment of debt of $45.7 million in 2009. The loss in 2010 was

comprised of charges of $110.2 million resulting from the October 2010 Refinancing and the

redemption of Series A Stock and a $1.4 million loss on extinguishment of debt subsequent to the

October 2010 Refinancing, partially offset by gains on extinguishment of debt of $4.6 million. The

charges consisted of approximately $64 million of deferred financing costs associated with our previous

securitized debt structure, including the remaining balance in Accumulated Other Comprehensive

Income of a loss related to an interest rate swap designated as a cash flow hedge, and approximately

$46 million of prepayment costs and tender premiums associated with the retirement of the securitized

debt. Tender premiums associated with the Series A Stock were included as dividends paid and not part

of the loss on extinguishment.

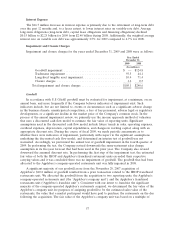

During 2010 (prior to the October 2010 Refinancing) and 2009, we recognized the following gains

on the early retirement of debt:

Face Amount

Transaction Date Instrument Retired Cash Paid Gain(1)

(In millions)

March 2010 Class A-2-II-X .............. $ 48.7 $ 43.8 $ 3.5

June 2010 Class A-2-II-X .............. 19.5 18.0 1.1

Total 2010 ................. $ 68.2 $ 61.8 $ 4.6

March, 2009 Class A-2-II-X .............. $ 78.4 $ 49.0 $26.4

May, 2009 Class A-2-II-A .............. 35.2 24.3 9.6

June, 2009 Class A-2-II-X .............. 15.6 12.1 2.8

November, 2009 Class A-2-II-X .............. 53.4 46.5 5.3

December, 2009 Class A-2-II-X .............. 17.0 15.0 1.6

Total 2009 ................. $199.6 $146.9 $45.7

(1) After write-off of the discount and deferred financing costs related to the debt retired.

We may continue to dedicate a portion of excess cash flow towards opportunistic debt retirement.

However, our debt no longer trades at a discount to face value, therefore future retirements will most

likely result in a loss on retirement due to the write-off of the discount and deferred financing costs

related to the debt retired.

51