IHOP 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Paid a $5.7 million redemption premium plus $0.9 million of accrued and unpaid dividends

associated with the redemption of the Series A Stock; and

• Paid $57.6 million of transaction costs related to the refinancing. These costs will be capitalized

and amortized as non-cash interest expense over the weighted average 7.4-year life of the related

indebtedness.

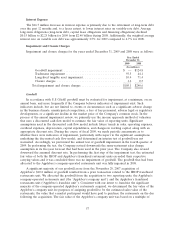

In addition, we wrote off approximately $64.2 million of costs associated with our previous

securitized debt structure, primarily comprised of $27.1 million of deferred financing costs,

$21.6 million representing the unamortized portion of a loss related to an interest rate swap designated

as a cash flow hedge reported in Accumulated Other Comprehensive Loss, unamortized debt discount

of $12.5 million and $3.0 million of issuance costs of the Series A Stock. We will receive a tax benefit

for most of these charges and for the $46.1 million of prepayment costs and tender premiums. The

redemption premium, dividends and write-off of issuance costs associated with the Series A Stock will

not be tax deductible.

In November 2010, we used net proceeds from the sale of 63 company-operated restaurants in

Minnesota and Wisconsin along with cash that previously had been restricted for the collateralization of

letters of credit to retire the remaining 47,000 shares of Series A Stock for $47.0 million. We paid a

redemption premium of $1.9 million plus accrued and unpaid dividends of $0.5 million in redeeming

the additional shares.

The material agreements entered into related to the October 2010 Refinancing were included as

Exhibit 4.1 and Exhibits 10.1and 10.2 of our quarterly report on Form 10-Q for the period ended

September 30, 2010 filed on November 3, 2010.

Based on our current level of operations, we believe that our cash flow from operations, available

cash and available borrowings under our Senior Secured Credit Facility will be adequate to meet our

liquidity needs during 2011.

February 2011 Refinancing

On February 25, 2011, we entered into Amendment No. 1 (the ‘‘Amendment’’) to the Credit

Agreement. Pursuant to the Amendment, the interest rate margin applicable to LIBOR-based loans

under the Term Facility was reduced from 4.50% to 3.00%, and the interest rate floors used to

determine the LIBOR and Base Rate reference rates for loans under the Term Facility were reduced

from 1.50% to 1.25% for LIBOR-based loans and from 2.50% to 2.25% for Base Rate denominated

loans.

In addition, the Amendment increased the available lender commitments under the Revolving

Facility from $50 million to $75 million. No amounts under the Revolving Facility were drawn as of

February 25, 2010. The Amendment also modified certain restrictive covenants of the Credit

Agreement, including those relating to repurchases of other debt securities, permitted acquisitions and

payments on equity.

The Amendment was included as Exhibit 10.1 of our Current Report on Form 8-K filed on

February 28, 2011.

As a result of the October 2010 Refinancing and the Amendment, we anticipate our 2011 cash

interest expense on indebtedness will be approximately $148 million, based on the debt balances

outstanding as of February 25, 2011 and current interest rates, a decrease of $8 million, or $5 million

after tax, from 2010. This decrease, in addition to the elimination of approximately $23 million in

non-deductible preferred stock dividend payments on the Series A Stock will result in a favorable

impact from the October 2010 Refinancing and the Amendment on our liquidity and fixed charges of

approximately $28 million.

63