IHOP 2010 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

18. Stock-Based Incentive Plans (Continued)

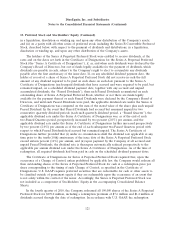

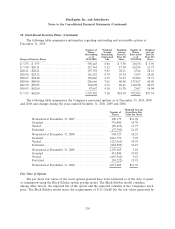

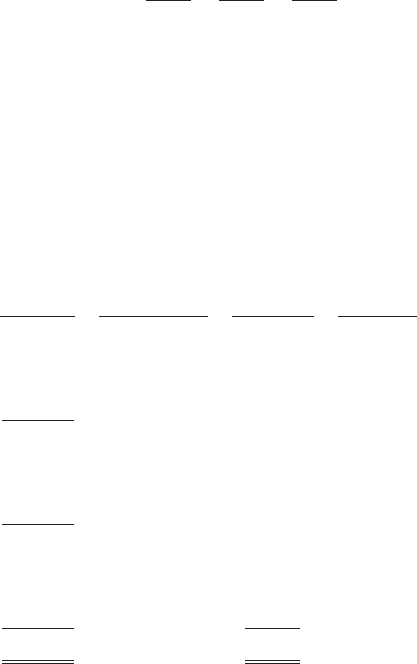

the model may not be indicative of the actual fair values of the Company’s stock-based awards. The

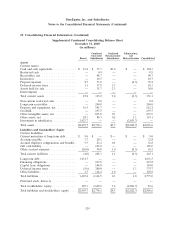

following table summarizes the assumptions used to value options granted in the respective periods:

2010 2009 2008

Risk free interest rate ............................ 2.19% 1.95% 2.83%

Weighted average historical volatility ................. 80.4% 72.3% 77.9%

Dividend yield .................................. — — 3.09%

Expected years until exercise ....................... 4.8 5.0 5.0

Forfeitures .................................... 11.0% 11.0% 7.02%

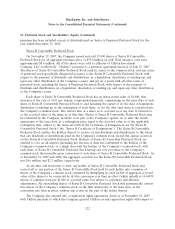

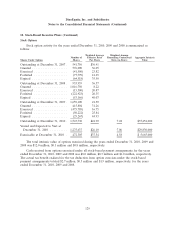

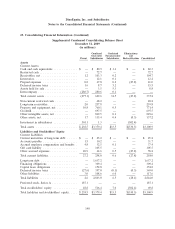

Restricted Stock and Restricted Stock Units

Restricted stock activity for the years ended December 31, 2010, 2009 and 2008 is set forth below:

Weighted Weighted

Average Average

Grant-Date Per Grant-Date

Number of Share Restricted Per Share

Shares Fair Value Stock Units Fair Value

Outstanding at December 31, 2007 .............. 435,290 $53.04 — —

Granted ................................. 399,785 38.75 — —

Released ................................. (72,520) 55.89 — —

Forfeited ................................ (91,075) 46.19 — —

Outstanding at December 31, 2008 .............. 671,480 45.07 — —

Granted ................................. 241,125 10.92 — —

Released ................................. (139,649) 51.40 — —

Forfeited ................................ (122,633) 34.23 — —

Outstanding at December 31, 2009 .............. 650,323 33.09 — —

Granted ................................. 209,505 30.52 20,000 $29.32

Released ................................. (159,893) 48.18 (2,000) 29.32

Forfeited ................................ (33,691) 34.16 — —

Outstanding at December 31, 2010 .............. 666,244 $28.62 18,000 $29.32

During the year ended December 31, 2010, the Company issued 29,000 shares of cash-based

Restricted Stock Units to members of the Board of Directors. As these instruments can only be settled

in cash they are recorded as liabilities based on the closing price of the Company’s common stock as of

December 31, 2010. For the year ended December 31, 2010, $1.2 million was included as stock-based

compensation expense related to these cash-based Restricted Stock Units. For the year ended

December 31, 2010, a total of 3,000 units were settled for a cash payment of $0.1 million.

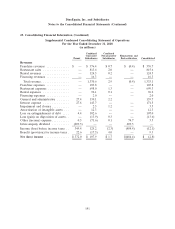

19. Employee Benefit Plans

401(k) Savings and Investment Plan

Effective January 1, 2009, the Company amended the DineEquity, Inc. 401(k) Plan to (i) include

salaried and hourly employees of Applebee’s, and (ii) modify the Company matching formula. As

amended, the Company matches 100% of the first three percent of the employee’s eligible

131