IHOP 2010 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

6. Goodwill (Continued)

month after the acquisition. The fair value of the franchise unit was determined using a discounted

cash flow based on forecast royalty revenues from the franchise operations. These fair values, which

reconciled to the overall purchase price paid to acquire Applebee’s, were then used to assign goodwill

between the reporting units as the excess of the estimated fair value of over the carrying value (as of

November 29, 2007) of each reporting unit. The goodwill resulting from this acquisition is not expected

to be deductible for tax purposes.

During 2008 the Company completed several refranchising transactions involving components of

the Company unit (see Note 4, Assets Held For Sale). The goodwill of the Company unit was reduced

by $11.3 million for the goodwill allocated to these restaurants.

In performing the 2008 annual impairment test of goodwill, the Company concluded the goodwill

allocated to the Company unit was fully impaired and an impairment charge of $113.5 million was

recorded (see Note 17, Impairment and Closure Charges).

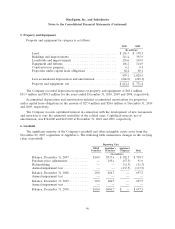

7. Other Intangible Assets

As of December 31, 2010 and 2009, intangible assets are as follows:

Not Subject to Amortization Subject to Amortization

Liquor Franchising Recipes and

Tradename Licenses Other Rights Menus Leaseholds Total

(In millions)

Balance, December 31, 2007 ....... $790.0 $ 6.4 $ — $199.5 $15.6 $ — $1,011.5

Additions ..................... — — — — — 7.3 7.3

Purchase price adjustments ........ — (1.7) — — — 0.4 (1.3)

Amortization expense ............ — — — (10.0) (2.1) (1.7) (13.8)

Impairment ................... (44.1) — — — — — (44.1)

Refranchising .................. — (1.8) — — — (1.8) (3.6)

Balance, December 31, 2008 ....... 745.9 2.9 — 189.5 13.5 4.2 956.0

Amortization expense ............ — — — (10.0) (2.3) (1.1) (13.4)

Impairment ................... (93.5) — — — — — (93.5)

Other ........................ — — 0.2 — — 0.3 0.5

Balance, December 31, 2009 ....... 652.4 2.9 0.2 179.5 11.2 3.4 849.6

Amortization expense ............ — — — (10.0) (2.3) (1.0) (13.3)

Impairment ................... — (0.3) — — — — (0.3)

Refranchising .................. — — — (0.2) — (1.2) (1.4)

Other ........................ — — 0.1 — — 1.2 1.3

Balance, December 31, 2010 ....... $652.4 $ 2.6 $0.3 $169.3 $ 8.9 $ 2.4 $ 835.9

See Note 17, Impairment and Closure Charges, regarding the impairments of the tradename

recognized in 2009 and 2008.

Annual amortization expense for next five fiscal years is estimated to be approximately

$12.2 million annually. The weighted average life of the intangible assets subject to amortization is 18.7

and 18.6 years at December 31, 2010 and 2009, respectively.

98