IHOP 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

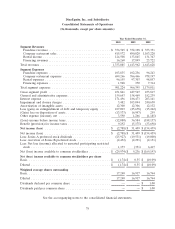

DineEquity, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(In thousands)

Year Ended December 31,

2010 2009 2008

Cash flows from operating activities

Net (loss) income ............................................... $ (2,788) $ 31,409 $(154,459)

Adjustments to reconcile net (loss) income to cash flows provided by operating activities

Depreciation and amortization ..................................... 61,427 65,379 72,934

Non-cash interest expense ........................................ 34,379 39,422 39,083

Loss (gain) on extinguishment of debt and temporary equity .................. 107,003 (45,678) (15,242)

Impairment and closure charges .................................... 3,482 105,094 240,630

Deferred income taxes .......................................... (15,484) (19,875) (65,226)

Non-cash stock-based compensation expense ............................ 13,085 10,710 12,089

Tax benefit from stock-based compensation ............................. 2,692 531 1,864

Excess tax benefit from stock options exercised ........................... (4,775) (48) (315)

(Gain) loss on disposition of assets .................................. (13,573) (6,947) 259

Other ..................................................... 5,430 (5,816) 1,172

Changes in operating assets and liabilities

Receivables ................................................ 3,736 11,607 (2,441)

Inventories ................................................ (263) (1,474) 182

Prepaid expenses ............................................. (9,148) (15,947) (7,418)

Current income tax receivables and payables ........................... (27,703) 5,001 20,456

Accounts payable ............................................ 27 (14,867) (23,749)

Accrued employee compensation and benefits .......................... (5,000) (8,119) (11,609)

Gift card liability ............................................ 19,507 7,180 18,480

Other accrued expenses ........................................ 7,248 286 (15,851)

Cash flows provided by operating activities ........................... 179,282 157,848 110,839

Cash flows from investing activities

Additions to property and equipment ................................. (18,677) (15,372) (31,765)

Reductions (additions) to long-term receivables ........................... 4,772 2,528 (4,743)

Acquisition of business, net of cash acquired ............................ — — (10,261)

Collateral released by captive insurance subsidiary ......................... 781 1,549 4,559

Proceeds from sale of property and equipment and assets held for sale ........... 51,642 15,777 61,137

Principal receipts from notes and equipment contracts receivable ............... 14,680 15,025 15,797

Other ..................................................... 306 (672) 471

Cash flows provided by investing activities ........................... 53,504 18,835 35,195

Cash flows from financing activities

Proceeds from issuance of long-term debt .............................. 1,725,000 10,000 35,000

Restricted cash related to securitization ................................ 119,133 15,878 49,216

Proceeds from financing obligations .................................. — — 370,502

Repayment of long-term debt (including tender premiums) ................... (1,777,946) (173,777) (421,325)

Redemption of temporary equity .................................... (190,000) — —

Payment of debt issuance costs ..................................... (57,602) (20,300) (48,902)

Principal payments on capital lease and financing obligations .................. (16,118) (16,160) (9,854)

Dividends paid (including temporary equity redemption premiums) .............. (26,117) (24,091) (33,362)

Repurchase of restricted stock ..................................... (1,884) (605) (540)

Proceeds from stock options exercised ................................ 7,968 324 989

Excess tax benefit from stock options exercised ........................... 4,775 48 315

Other ..................................................... — (129) (468)

Cash flows used in financing activities .............................. (212,791) (208,812) (58,429)

Net change in cash and cash equivalents ............................... 19,995 (32,129) 87,605

Cash and cash equivalents at beginning of year ........................... 82,314 114,443 26,838

Cash and cash equivalents at end of year ............................... $ 102,309 $ 82,314 $ 114,443

Supplemental disclosures

Interest paid ................................................. $ 141,139 $ 166,361 $ 194,763

Income taxes paid ............................................. $ 33,389 $ 31,245 $ 40,931

See the accompanying notes to the consolidated financial statements.

80