IHOP 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The increase in Applebee’s franchise closings in 2009 was due primarily to the closing of seven

restaurants after the franchise agreements were terminated due to nonpayment of royalties and

advertising fees. One of the seven restaurants re-opened under new ownership in 2009, one in 2010 and

the Company expects one additional restaurant to re-open under new ownership in 2011.

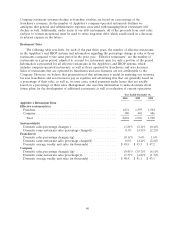

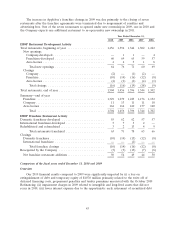

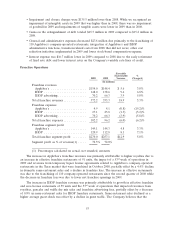

Year Ended December 31,

2010 2009 2008 2007 2006

IHOP Restaurant Development Activity

Total restaurants, beginning of year ..................... 1,456 1,396 1,344 1,302 1,242

New openings

Company-developed ............................. — 1 1 — 4

Franchisee-developed ............................ 60 69 65 59 57

Area license ...................................46518

Total new openings ............................ 64 76 71 60 69

Closings

Company ..................................... (2) — (1) (2) —

Franchise ..................................... (10) (14) (16) (12) (8)

Area license ................................... (4) (2) (2) (4) (1)

Total closings ................................ (16) (16) (19) (18) (9)

Total restaurants, end of year .......................... 1,504 1,456 1,396 1,344 1,302

Summary—end of year

Franchise ...................................... 1,329 1,279 1,225 1,176 1,132

Company ....................................... 11 13 11 11 10

Area license .................................... 164 164 160 157 160

Total ...................................... 1,504 1,456 1,396 1,344 1,302

IHOP Franchise Restaurant Activity

Domestic franchisee-developed ........................ 55 62 62 57 57

International franchisee-developed ......................5732—

Rehabilitated and refranchised ......................... 3 2 13 4 9

Total restaurants franchised ...................... 63 71 78 63 66

Closings

Domestic franchisee ............................... (10) (14) (15) (12) (8)

International franchisee ............................ — — (1) — —

Total franchise closings ......................... (10) (14) (16) (12) (8)

Reacquired by the Company .......................... (3) (3) (13) (7) (8)

Net franchise restaurant additions ..................... 50 54 49 44 50

Comparison of the fiscal years ended December 31, 2010 and 2009

Overview

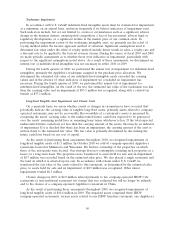

Our 2010 financial results compared to 2009 were significantly impacted by (i) a loss on

extinguishment of debt and temporary equity of $107.0 million primarily related to the write off of

deferred financing costs, prepayment penalties and tender premiums associated with the October 2010

Refinancing; (ii) impairment charges in 2009 related to intangible and long-lived assets that did not

recur in 2010; (iii) lower interest expense due to the opportunistic early retirement of securitized debt

43