IHOP 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

8. Debt (Continued)

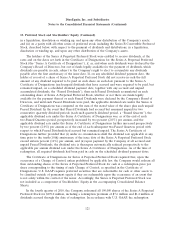

Retirement of Debt

During the ten-month period prior to the October 2010 Refinancing and the twelve-month period

ended December 31, 2009, the Company recognized the following gains on the early retirement of

debt:

Face Amount

Transaction Date Instrument Retired Cash Paid Gain(1)

(In millions)

March 2010 Class A-2-II-X .............. $ 48.7 $ 43.8 $ 3.5

June 2010 Class A-2-II-X .............. 19.5 18.0 1.1

Total 2010 ................. $ 68.2 $ 61.8 $ 4.6

March 2009 Class A-2-II-X .............. $ 78.4 $ 49.0 $26.4

May 2009 Class A-2-II-A .............. 35.2 24.3 9.6

June 2009 Class A-2-II-X .............. 15.6 12.1 2.8

November, 2009 Class A-2-II-X .............. 53.4 46.5 5.3

December, 2009 Class A-2-II-X .............. 17.0 15.0 1.6

Total 2009 ................. $199.6 $146.9 $45.7

(1) After write-off of the discount and deferred financing costs related to the debt retired.

Scheduled monthly payments on the Series 2007-1 Class M-1 Fixed Rate Term Subordinated Notes

due December 2037 totaled $15.1 million during the ten-month period prior to the October 2010

Refinancing and $15.0 million during the twelve-month period ended December 31, 2009.

During fiscal 2009, the Company received proceeds from disposition of assets and release of

certain reserve funds totaling $11.8 million. As required by the terms of the Applebee’s securitization

agreements (discussed below), these funds were used to retire Series 2007-1 Class A-2-II-X Fixed Rate

Term Senior Notes and Series 2007-1 Class A-2-II-A Fixed Rate Term Senior Notes at face values of

$5.5 million and $6.3 million, respectively.

9. Financing Obligations

On May 19, 2008, the Company entered into a Purchase and Sale Agreement relating to the sale

and leaseback of 181 parcels of real property (the ‘‘Sale-Leaseback Transaction’’), each of which is

improved with a restaurant operating as an Applebee’s Neighborhood Grill and Bar (the ‘‘Properties’’).

On June 13, 2008, the closing date of the Sale-Leaseback Transaction, the Company entered into a

Master Land and Building Lease (‘‘Master Lease’’) for the Properties. The proceeds received from the

transaction were $337.2 million. The Master Lease calls for an initial term of twenty years and four

five-year options to extend the term.

The Company has an ongoing obligation related to the Properties until such time as the lease

related to each of the Properties is assigned to a qualified franchisee in a transaction meeting certain

parameters set forth in the Master Lease. Due to this continuing involvement, the transaction was

recorded under the financing method in accordance with U.S. GAAP governing sale-leaseback

transactions involving real estate. Accordingly, the value of the land, buildings and improvements will

remain on the Company’s books and the buildings and improvements will continue to be depreciated

112