IHOP 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

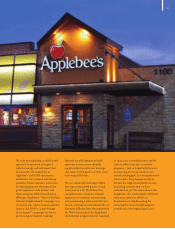

designed to keep the brand relevant and foster a real, genuine

connection with our guests. Whether through unique limited-

time offers that leverage IHOP’s core breakfast equities, menu

innovations like the new “Simple & Fit” offerings or expanding

awareness around dinner through programs like “Kids Eat

Free,” we are focused on initiatives that respond to guest

needs and promote IHOP as a favorite destination in family

dining. Franchisees are embracing our next generation

remodel and updating their restaurants in line with our

expectations, while they also continue to open approximately

60 new IHOP restaurants each year. Beyond traditional

restaurant development, IHOP also has made strides with

brand extension activities, particularly around strengthening

our third-party gift card distribution partnership. It is a simple

and effective way to extend the IHOP brand and enhance

consumer awareness that supplements in-restaurant gift

card sales. We are also excited about the testing work we are

conducting around smaller format, streamlined menu and

limited service locations that could prove to be another area

of growth for IHOP franchisees over time.

While competitors strayed from their brand positioning

and employed detrimental discounting strategies during

challenging economic times, IHOP’s dedication to brand

building initiatives enabled us to operate from a position of

strength and maintain our number one position in family

dining. As we look ahead, we will continue to look to optimize

IHOP’s strong brand position and take our strategies to the

next level.

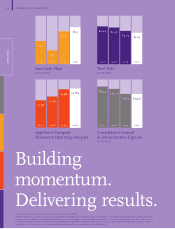

Opportunistic, accretive renancing completed

I am also pleased to report that, in October 2010, we successfully

completed a $1.8 billion renancing of the Company.

With this renancing, we addressed our previously complex

capital structure in a holistic manner while opportunistically

taking advantage of favorable conditions in the debt markets.

The primary goal was to eliminate the renancing risk we

would have faced when all of the securitized debt matured in

2012. We also wanted to put in place a new capital structure

with attractive interest rates, extend our maturities on the

debt, and have the ability to reduce debt and leverage from our

free cash ow over time. Our new bank and bond structure

achieves those objectives. In the process, we also minimized

prepayment penalties associated with replacing our securitized

debt structure and redeemed all of our Series A perpetual

preferred stock in an accretive transaction. More recently, in

February 2011, we secured a lower interest rate on our bank

debt through an opportunistic re-pricing transaction.

We now move forward with a more favorable capital structure

that maximizes our nancial exibility and allows us to focus

on executing our growth plans for both the Applebee’s and

IHOP brands.

The DineEquity difference

Looking ahead, we remain committed to executing our strategic

plan for Applebee’s and IHOP. This includes differentiating

the Applebee’s and IHOP brands with exceptional operations,

strategic marketing, innovative menu offerings and impactful

remodel programs. We rmly believe that offering compelling,

differentiated value propositions and promoting occasion-

based appeal are essential to driving trafc and remaining

relevant to our guests. This targeted, strategic and integrated

approach to brand management, along with our highly

franchised business model, clearly differentiates DineEquity

from the competitive set.

Our approach is further amplied by the strength and

support of our franchisees and team members who continue

to awlessly execute our brand strategies system-wide. We

believe our highly franchised model challenges our brands

to perform at a higher level, as it necessitates collaboration

and fosters better brand management and effective decision-

making across the board. Furthermore, DineEquity’s Shared

Services corporate operating structure is an efcient and

effective platform from which to leverage the collective talents

of not only Shared Services, but also Applebee’s and IHOP

management and team members, to ensure our brands

remain number one in their respective categories.

I express my sincere thanks to our team members, franchisees,

purchasing co-operative, vendor partners, Board of Directors,

and to you, our shareholders, for your steadfast support.

Julia A. Stewart

Chairman and Chief Executive Ofcer

DineEquity, Inc.

and to you, our shareholders, for your steadfast support.

DINE EQUITY 2010

ANNUAL REPORT

14 PAGES + COVER

Trim Size:

8.25 x 10.75

Spot colors:

PMS 268

PMS 179

Overall Satin AQ

___

PAGE 3:

Image is hi-res

Rule prints PMS 268

Type prints PMS 268,

PMS 179 + 100%K

lIVe Art signature

TIFF prints 100%K