IHOP 2010 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

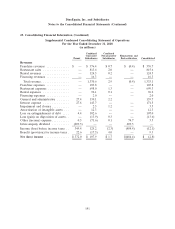

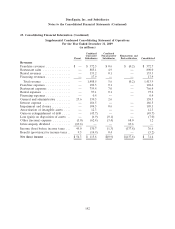

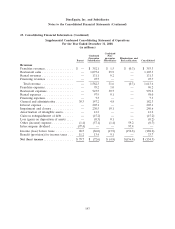

24. Selected Quarterly Financial Data (Unaudited)

Net Income Net Income

(Loss) (Loss)

Operating Net Income Per Share— Per Share—

Revenues(a) Margin (Loss) Basic(b) Diluted(b)

(In thousands, except per share amounts)

2010

1st Quarter ........................ $357,972 $115,639 $ 19,671 $ 0.75 $ 0.75

2nd Quarter ....................... 339,923 108,074 14,041 0.43 0.42

3rd Quarter ....................... 335,400 107,978 14,331 0.45 0.44

4th Quarter(c) ..................... 299,790 100,170 (50,831) (3.33) (3.33)

2009

1st Quarter ........................ $375,556 $120,853 $ 37,141 $ 1.82 $ 1.80

2nd Quarter ....................... 349,650 109,119 24,814 1.11 1.09

3rd Quarter ....................... 333,551 104,590 13,505 0.46 0.46

4th Quarter(d) ..................... 355,205 113,005 (44,051) (2.84) (2.84)

(a) Revenues have been impacted by the franchising of 83 company-operated Applebee’s restaurants

in the fourth quarter of 2010 and seven company-operated Applebee’s restaurants in the first half

of 2009.

(b) The quarterly amounts may not add to the full year amount as each quarterly calculation is

discrete from the full-year calculation.

(c) The net loss and net loss per share were significantly impacted by approximately $110 million of

charges related to the retirement of debt and temporary equity in the 4th quarter of 2010.

(d) Revenue and operating margin were impacted by a 53rd week in fiscal 2009, which resulted in a

14-week 4th quarter. The net loss and net loss per share were significantly impacted by impairment

charges taken against intangible assets in the 4th quarter of 2009.

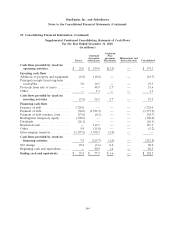

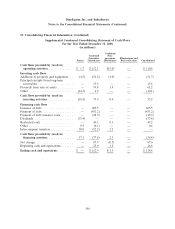

25. Subsequent Events

On January 25, 2011, the Company completed the sale of 36 Applebee’s company-operated

restaurants in the St. Louis, Missouri area. On February 17, 2011, The Company completed the sale of

29 Applebee’s company-operated restaurants in the Washington, D.C. area.

On February 25, 2011, the Company entered into Amendment No. 1 (the ‘‘Amendment’’) to the

Credit Agreement among the Company, each lender from time to time party thereto and the agents

named therein

Pursuant to the Amendment, the interest rate margin applicable to LIBOR based term loans was

reduced from 4.50% to 3.00%, and the interest rate floors used to determine the LIBOR and Base

Rate reference rates for term loans was reduced from 1.50% to 1.25% for LIBOR based term loans

and from 2.50% to 2.25% for Base Rate denominated term loans.

In addition, the Amendment increased the available lender commitments under the Revolving

Credit Facility from $50 million to $75 million The amendment also modified certain restrictive

covenants of the Credit Agreement, including those relating to repurchases of other debt securities,

permitted acquisitions and payments on equity.

147