IHOP 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

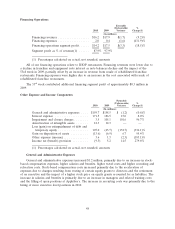

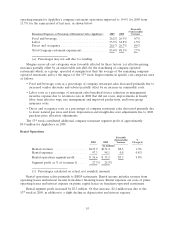

Gain on Disposition of Assets

We recognized a gain on disposition of assets of $13.6 million in 2010, primarily related to the

franchising of 63 Applebee’s restaurants in the Minnesota market and 20 restaurants in the Roanoke

and Lynchburg markets in Virginia. We recognized a gain on disposition of assets of $6.9 million in

2009, primarily related to the franchising of seven Applebee’s restaurants in the New Mexico market

and sale of a parcel of land held by IHOP.

Other Expense (Income)

In 2010, other items of income and expense netted to an expense of $3.6 million compared to an

expense of $1.3 million in 2009. The primary reason for the change was several individually insignificant

gains in 2009 did not recur in 2010.

Income Tax (Provision) Benefit

We recognized a tax benefit of $9.3 million in 2010 as compared to a tax provision of $5.2 million

in 2009. The change was primarily due to the decrease in pre-tax income resulting from the one time

expenses related to the debt refinancing. The 2010 effective tax rate benefit of 76.9% applied to pretax

book income was significantly different from the statutory federal tax rate of 35% primarily due to the

decrease in pre-tax income resulting from the one-time expenses related to the debt refinancing,

changes in unrecognized tax benefits and tax credits. The tax credits are primarily FICA tip and other

compensation-related tax credits associated with Applebee’s company-owned restaurant operations and

credits associated with the Applebee’s Restaurant Support Center in Lenexa, Kansas.

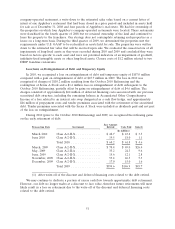

Comparison of the fiscal years ended December 31, 2009 and 2008

Overview

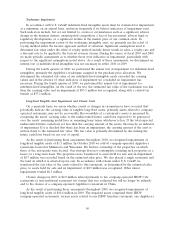

Our 2009 financial results were significantly impacted by (i) impairment charges related to

intangible and long-lived assets; (ii) gains on the opportunistic early retirement of debt with excess cash

flow; (iii) reductions of general and administrative and interest expenses; (iv) a 53rd calendar week

included in fiscal 2009; and (v) the franchising of 110 Applebee’s company-operated restaurants since

the second quarter of 2008. In comparing the Company’s financial results for 2009 to those of 2008, we

note:

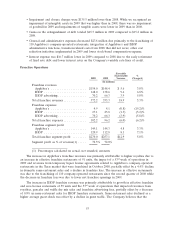

• Revenues decreased $200.0 million to $1.4 billion in 2009 from $1.6 billion in 2008. The decline

was primarily due to the net effect of franchising 110 company-operated Applebee’s restaurants

since the second quarter of 2008 and a decline in IHOP and Applebee’s same-restaurant sales,

partially offset by an increase in IHOP and Applebee’s effective franchise units.

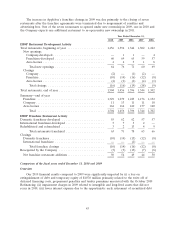

• Segment profit for 2009 increased $13.8 million, comprised as follows:

Franchise operations .......................................... $12.9

Company restaurant operations .................................. (1.5)

Rental operations ............................................ 3.3

Financing operations .......................................... (0.9)

Total segment profit .......................................... $13.8

The increase was primarily due to the favorable impact of the 53rd week, an increase in IHOP and

Applebee’s effective franchise units and margin improvements in Applebee’s company-operated

restaurants partially offset by the net effect of franchising 110 company-operated Applebee’s

restaurants since the second quarter of 2008 and a decline in Applebee’s and IHOP

same-restaurant sales.

52