IHOP 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

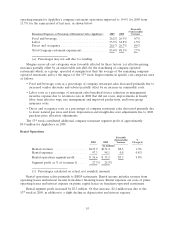

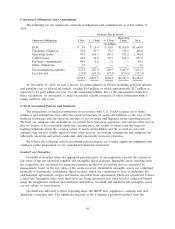

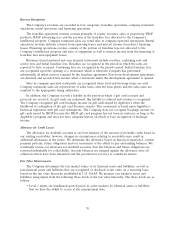

The EBITDA used in calculating these ratios is considered to be a non-U.S. GAAP measure. The

reconciliation between our loss before income taxes, as determined in accordance with U.S. GAAP, and

EBITDA used for covenant compliance purposes is as follows:

Trailing Twelve Months Ended December 31, 2010

(in thousands)

U.S. GAAP loss before income taxes ......................... $(12,080)

Interest charges ........................................ 190,739

Loss on retirement of debt and temporary equity ................ 107,003

Depreciation and amortization .............................. 61,427

Non-cash stock-based compensation .......................... 13,085

Impairment and closure charges ............................. 3,482

Other ................................................ 1,930

Gain on disposition of assets ............................... (13,573)

EBITDA .............................................. $352,013

We believe this non-U.S. GAAP measure is useful in evaluating our results of operations in

reference to compliance with the debt covenants discussed above. This non-U.S. GAAP measure is not

defined in the same manner by all companies and may not be comparable to other similarly titled

measures of other companies. Non-U.S. GAAP measures should be considered in addition to, and not

as a substitute for, the U.S. GAAP information contained within our financial statements.

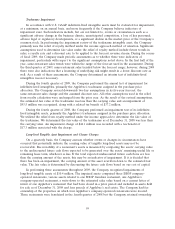

Franchising of Applebee’s Company-Operated Restaurants

During 2010, we completed the franchising of 63 company-operated Applebee’s restaurants in the

Minnesota/Wisconsin market and 20 company-operated Applebee’s restaurants in the Roanoke/

Lynchburg markets in the state of Virginia. Proceeds from asset dispositions, including the 83

restaurants, totaled $51.6 million for the twelve months ended December 31, 2010, the majority of

which was used to redeem Series A Stock and retire debt.

Since the Applebee’s acquisition we have pursued a strategy to transition from the 74% franchised

Applebee’s system at the time of the acquisition to an approximately 98% franchised Applebee’s

system, similar to IHOP’s 99% franchised system. As of December 31, 2010, we have franchised 193

Applebee’s company-operated restaurants since the second quarter of 2008. Subsequent to

December 31, 2010 we franchised 36 restaurants in the St. Louis market in January 2011 and 29 of 30

restaurants in the Washington, D.C. market in February, 2011; the sale of the one remaining

Washington, D.C. restaurant is expected to close before the end of the second fiscal quarter of 2011.

Including the 65 restaurants franchised in the first quarter of 2011, the Applebee’s system is

approximately 89% franchised We are planning to franchise a significant majority of the remaining 243

company-operated Applebee’s over the next several years while retaining part of the Kansas City area

as a Company market. This heavily franchised business model is expected to require less capital

investment, improve margins and reduce the volatility of cash flow performance over time, while also

providing cash proceeds from the franchising of the restaurants for the retirement of debt. Under the

terms of the Credit Agreement, all of the proceeds of future asset dispositions must be used to repay

borrowings under the Term Facility and under certain conditions, we may be required to repurchase

Notes with excess proceeds of assets sales, as defined in the Indenture under which the Notes were

issued.

65