IHOP 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.approximately six times the operating cash flow for the trailing twelve months of the Applebee’s

company unit. This multiple was supported by actual refranchising transactions negotiated within a

month after the acquisition. The fair value of the franchise unit was determined using a discounted

cash flow based on forecast royalty revenues from the franchise operations. These fair values, which

reconciled to the overall purchase price paid to acquire Applebee’s, were then used to assign goodwill

between the reporting units as the excess of the estimated fair value over the carrying value (as of

November 29, 2007) of each reporting unit.

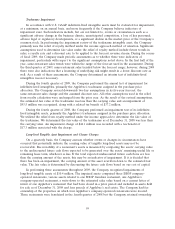

During the course of fiscal 2008, we made periodic assessments as to whether there were

indicators of impairment, particularly with respect to the significant assumptions underlying the

discounted cash flow model. Those assessments included consideration of the uncertainty with respect

to the depth and duration of the economic slowdown and the timing of a recovery, and the fact that

the Company was in the process of implementing several initiatives designed to improve Applebee’s

same-restaurant-sales and margin performance. These assessments concluded that the sales forecasts

being used to assess potential impairment were achievable within ranges that did not indicate

impairment. We therefore determined an interim test of goodwill during the first three quarters of 2008

was not warranted.

In the fourth quarter of 2008, we performed the annual test for impairment of goodwill, utilizing a

discounted cash flow model of the income approach as described above. The impairment test of

goodwill of the two Applebee’s units was performed as of October 31, 2008. The impairment test of the

goodwill of the IHOP unit (‘‘IHOP unit’’) was performed as of December 31, 2008, the date as of

which the analysis has been performed in prior years. Towards the latter part of 2008, while there was

still considerable uncertainty with respect to the economic slowdown, the prevailing view was that a

recovery was not likely to begin until the latter half of 2009 or early 2010. Therefore, during the fourth

quarter of 2008, we revised downward our forecasted sales assumption for 2009 which also impacted

the assumed cash flows for both 2009 and the following 2010-2013 time period due to an assumed

lower base from which the 2010-2013 time period had originally been projected. We also revised our

projections with respect to both the estimated timing and estimated proceeds to be received from the

franchising of Applebee’s company-operated restaurants.

The first step of the impairment test compared the fair value of each of our reporting units to

their carrying value. Based on this first step, we concluded that the fair value of the IHOP unit and the

Applebee’s franchise unit was in excess of their respective net carrying values and no impairment of

goodwill was warranted. However, because of downward revisions to the 2009-2013 sales forecast and

to franchising proceeds, the fair value of the Applebee’s company unit was less than the net carrying

value of its assets assigned, requiring the second step of the impairment test. In performing the second

step of the impairment test we concluded that the goodwill allocated to the Applebee’s company unit

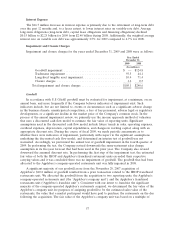

was fully impaired and an impairment charge of $113.5 million was recorded. No tax benefit was

associated with the impairment of goodwill.

Subsequent to the annual test of impairment as of October 31, 2008, the commercial real estate

market continued to weaken, the credit markets continued constrained, economic forecasts were

uncertain as to how long the recessionary period would last, and the company’s stock price declined.

We concluded an interim test of goodwill of the Applebee’s franchise unit was warranted. We again

revised the significant assumptions underlying the discounted cash flow model and updated our

impairment analysis of the Applebee’s franchise unit as of December 31, 2008. The Company

determined the fair value of the Applebee’s franchise unit was still in excess of its carrying value as of

December 31, 2008 and no impairment was required.

58