IHOP 2010 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

19. Employee Benefit Plans (Continued)

compensation deferral and 50% of the next two percent of the employee’s eligible compensation

deferral. All contributions under this plan vest immediately. DineEquity common stock is not an

investment option for employees in the 401(k) plan. Substantially all of the administrative cost of the

401(k) plan is borne by the Company. The Company’s contribution was $3.0 million and $3.5 million

for the years ended December 31, 2010 and 2009, respectively.

Under a predecessor plan covering IHOP employees, the Company matched 100% of the

employees’ contributions up to 3.0% of eligible compensation. The Company’s contribution for the

predecessor plan was $0.6 million for the year ended December 31, 2008. In 2008, the Company also

funded to eligible participants in the 401(k) plan, a profit sharing cash contribution equal to 3% of

eligible compensation. The Company’s profit sharing contribution was $0.9 million for the plan year

2008.

Prior to the acquisition, Applebee’s had established a defined contribution plan authorized under

Section 401(k) of the Internal Revenue Code which was assumed by the Company in connection with

the acquisition. Through December 2008 the Company made matching cash contributions of 50% of

each eligible employee’s contributions not to exceed 4% of their annual compensation. All

contributions under this plan vested immediately. Predecessor Applebee’s had made matching

contributions in the calendar year following the end of each plan year; accordingly, the Company made

no contributions in 2007 following the acquisition. Beginning in January 2008, the Company made

matching contributions each payroll period. The Company made matching contributions of $3.4 million

in 2008, representing its matching contributions for 2008 and the 2007 period subsequent to the

acquisition and Predecessor Applebee’s matching contributions for 2007.

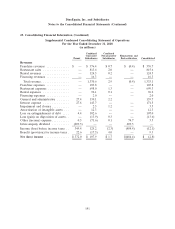

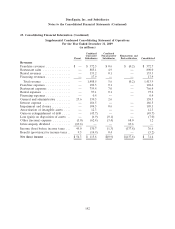

20. Income Taxes

The (benefit) provision for income taxes for the years ended December 31, 2010, 2009 and 2008 is

as follows:

Year Ended December 31,

2010 2009 2008

(In millions)

Provision for income taxes:

Current

Federal .................................... $ 6.2 $28.8 $ 25.5

State and foreign ............................. (0.6) 4.2 4.7

5.6 33.0 30.2

Deferred

Federal .................................... (12.8) (21.4) (54.1)

State ...................................... (2.1) (6.4) (9.8)

(14.9) (27.8) (63.9)

Provision (benefit) for income taxes ................. $ (9.3) $ 5.2 $(33.7)

132