IHOP 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DineEquity, Inc. and Subsidiaries

Notes to the Consolidated Financial Statements (Continued)

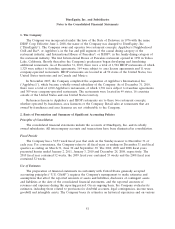

2. Basis of Presentation and Summary of Significant Accounting Policies (Continued)

Company’s intellectual property and sales of equipment as well as interest income from the financing of

franchise fees and equipment leases.

Revenues from franchised and area licensed restaurants include royalties, continuing rent and

service fees and initial franchise fees. Royalties are recognized in the period in which the sales are

reported to have occurred. Continuing fees are recognized in the period earned. Initial franchise fees

are recognized upon the opening of a restaurant, which is when the Company has performed

substantially all initial services required by the franchise agreement. Fees from development agreements

are deferred and recorded into income when a restaurant under the development agreement is opened.

Sales by company-operated restaurants are recognized when food and beverage items are sold.

Company restaurant sales are reported net of sales taxes collected from guests and the sales taxes are

remitted to the appropriate taxing authorities.

In addition, the Company records a liability in the period in which a gift card is issued and

proceeds are received. As gift cards are redeemed, this liability is reduced and revenue is recognized.

The Company recognizes gift card breakage income on gift cards issued by Applebee’s when the

assessment of the likelihood of redemption of the gift card becomes remote. This assessment is based

upon Applebee’s historical experience with gift card redemptions. The Company does not record

breakage income on gift cards issued by IHOP because the IHOP gift card program has not been in

existence as long as the Applebee’s program and does not have adequate history on which to base

recognition of breakage income.

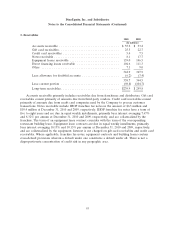

Allowance for Credit Losses

The allowance for doubtful accounts is our best estimate of the amount of probable credit losses in

our existing receivables; however, changes in circumstances relating to receivables may result in

additional allowances in the future. We determine the allowance based on historical experience, current

payment patterns, future obligations and our assessment of the ability to pay outstanding balances. We

continually review our allowance for doubtful accounts. Past due balances and future obligations are

reviewed individually for collectability. Account balances are charged against the allowance after all

collection efforts have been exhausted and the potential for recovery is considered remote.

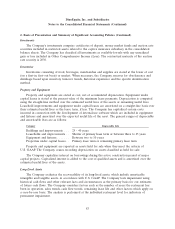

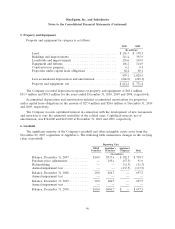

Leases

The Company leases the majority of all IHOP restaurants. The restaurants are subleased to IHOP

franchisees or, in a few instances, are operated by the Company. The Company’s IHOP leases generally

provide for an initial term of 15 to 25 years, with most having one or more five-year renewal options at

the Company’s option. In addition, the Company leases a majority of its company-operated Applebee’s

restaurants. Franchisees are responsible for financing their properties. The Applebee’s company-

operated leases generally have an initial term of 10 to 20 years, with renewal terms of five to 20 years,

and provide for a fixed rental plus, in certain instances, percentage rentals based on gross sales. The

rental payments or receipts on leases that meet the operating lease criteria are recorded as rental

expense or rental income. Rental expense and rental income for these operating leases are recognized

on the straight-line basis over the original terms of the leases. The difference between straight-line rent

expense or income and actual amounts paid or received represents deferred rent and is included in the

balance sheets as other assets or other liabilities, respectively.

86