IHOP 2010 Annual Report Download - page 89

Download and view the complete annual report

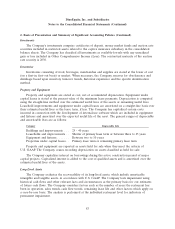

Please find page 89 of the 2010 IHOP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Under U.S. GAAP addressing the accounting for uncertainty in income taxes, tax positions that

previously failed to meet the more-likely-than-not threshold should be recognized in the first

subsequent financial reporting period in which that threshold is met. Previously recognized tax positions

that no longer meet the more-likely-than-not threshold should be derecognized in the first subsequent

financial reporting period in which that threshold is no longer met. We are subject to taxation in many

jurisdictions, and the calculation of our tax liabilities involves dealing with uncertainties in the

application of complex tax laws and regulations in various tax jurisdictions. The application is subject to

legal and factual interpretation, judgment and uncertainty. Tax laws and regulations themselves are

subject to change as a result of changes in fiscal policy, changes in legislation, the evolution of

regulations and court rulings. Therefore, the actual liability for taxes may be materially different from

our estimates, which could result in the need to record additional tax liabilities or to reverse previously

recorded tax liabilities.

Insurance Reserves

We use estimates in the determination of the appropriate liabilities for general liability, workers’

compensation and health insurance. The estimated liability is established based upon historical claims

data and third-party actuarial estimates of settlement costs for incurred claims. Unanticipated changes

in these factors may require us to revise our estimates. We periodically reassess our assumptions and

judgments and make adjustments when significant facts and circumstances dictate. A change in any of

the above estimates could impact our consolidated statements of earnings, and the related asset or

liability recorded in our consolidated balance sheets would be adjusted accordingly. Historically, actual

results have not been materially different than the estimates that are described above.

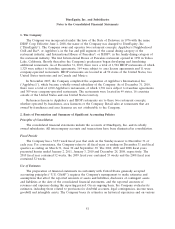

Recently Adopted Accounting Standards

In December 2009, the Financial Accounting Standards Board (‘‘FASB’’) issued Accounting

Standards Update (‘‘ASU’’) 2009-17, ‘‘Improvements to Financial Reporting by Enterprises Involved with

Variable Interest Entities.’’ This ASU, among other things, (i) changes existing guidance for determining

whether an entity is a Variable Interest Entity (‘‘VIE’’); (ii) requires ongoing reassessments of whether

an entity is the primary beneficiary of a VIE; and (iii) requires enhanced disclosures about an entity’s

involvement in a VIE. The Company adopted these amendments effective January 1, 2010, and

adoption had no impact on the Company’s consolidated financial statements.

In January 2010, the FASB issued ASU No. 2010-06, ‘‘Improving Disclosures About Fair Value

Measurement’’ (‘‘ASU 2010-06’’). This ASU added disclosure requirements about transfers related to

assets and liabilities measured using Level 1 and 2 inputs (as defined); clarified existing fair value

disclosure requirements about the appropriate level of disaggregation; and clarified that a description

of valuation techniques and inputs used to measure fair value was required for recurring and

nonrecurring fair value measurements of assets and liabilities using Level 2 and 3 inputs (as defined).

The Company adopted these provisions of the ASU beginning with the consolidated financial

statements for the period ended March 31, 2010. The adoption of these provisions of this ASU only

affected the disclosure requirements for fair value measurements and as a result had no impact on the

Company’s balance sheets, statements of operations or statements of cash flows.

In February 2010, the FASB issued ASU 2010-09, ‘‘Subsequent Events: Amendments to Certain

Recognition and Disclosure Requirements.’’ This ASU retracts the existing requirement to disclose the

date through which subsequent events have been evaluated and whether that date is the date the

financial statements were issued or were available to be issued. The guidance was effective immediately

upon issuance and adoption had no impact on the Company’s financial statements.

73