Honeywell 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

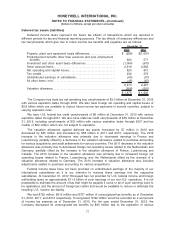

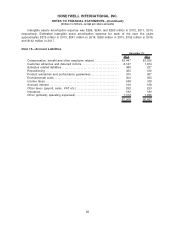

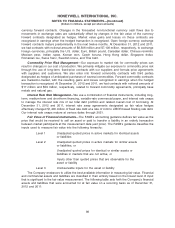

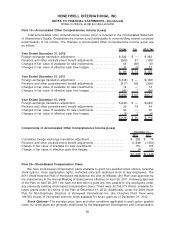

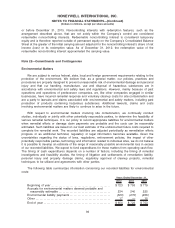

2012 2011

December 31,

Assets:

Foreign currency exchange contracts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 52 $ 26

Available for sale investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 518 359

Interest rate swap agreements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 146 134

Forward commodity contracts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 1

Liabilities:

Foreign currency exchange contracts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 32 $ 52

Forward commodity contracts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 10

The foreign currency exchange contracts, interest rate swap agreements, and forward commodity

contracts are valued using broker quotations, or market transactions in either the listed or over-the-

counter markets. As such, these derivative instruments are classified within level 2. The Company

holds investments in marketable equity securities that are designated as available for sale and are

valued using quoted market prices. As such, these investments are classified within level 1. The

Company also holds investments in commercial paper, certificates of deposits, and time deposits that

are designated as available for sale and are valued using market transactions in over-the-counter

markets. As such, these investments are classified within level 2.

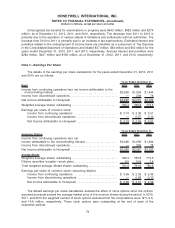

The carrying value of cash and cash equivalents, trade accounts and notes receivables, payables,

commercial paper and short-term borrowings contained in the Consolidated Balance Sheet

approximates fair value. The following table sets forth the Company’s financial assets and liabilities

that were not carried at fair value:

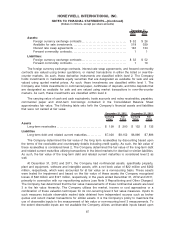

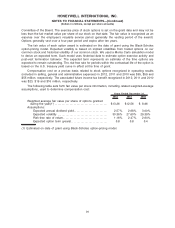

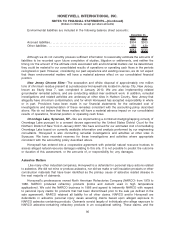

Carrying

Value

Fair

Value

Carrying

Value

Fair

Value

December 31, 2012 December 31, 2011

Assets

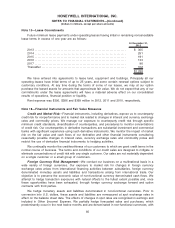

Long-term receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 199 $ 200 $ 132 $ 132

Liabilities

Long-term debt and related current maturities. . . . . . . . . . . $7,020 $8,152 $6,896 $7,896

The Company determined the fair value of the long term receivables by discounting based upon

the terms of the receivable and counterparty details including credit quality. As such, the fair value of

these receivables is considered level 2. The Company determined the fair value of the long-term debt

and related current maturities utilizing transactions in the listed markets for identical or similar liabilities.

As such, the fair value of the long-term debt and related current maturities is considered level 2 as

well.

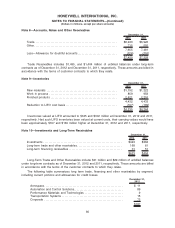

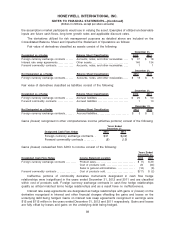

At December 31, 2012 and 2011, the Company had nonfinancial assets, specifically property,

plant and equipment, software and intangible assets, with a net book value of $22 million and $262

million, respectively, which were accounted for at fair value on a nonrecurring basis. These assets

were tested for impairment and based on the fair value of these assets the Company recognized

losses of $22 million and $127 million, respectively, in the years ended December 31, 2012 and 2011,

primarily in connection with our repositioning actions (see Note 3 Repositioning and Other Charges).

The Company has determined that the fair value measurements of these nonfinancial assets are level

3 in the fair value hierarchy. The Company utilizes the market, income or cost approaches or a

combination of these valuation techniques for its non-recurring level 3 fair value measures. Inputs to

such measures include observable market data obtained from independent sources such as broker

quotes and recent market transactions for similar assets. It is the Company’s policy to maximize the

use of observable inputs in the measurement of fair value or non-recurring level 3 measurements. To

the extent observable inputs are not available the Company utilizes unobservable inputs based upon

87

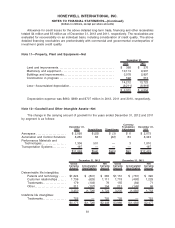

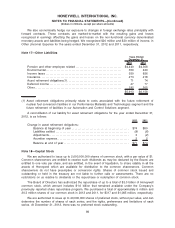

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)