Honeywell 2012 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 9B. Other Information

Not Applicable.

Item 10. Directors and Executive Officers of the Registrant

Information relating to the Directors of Honeywell, as well as information relating to compliance

with Section 16(a) of the Securities Exchange Act of 1934, will be contained in our definitive Proxy

Statement involving the election of the Directors, which will be filed with the SEC pursuant to

Regulation 14A not later than 120 days after December 31, 2012, and such information is incorporated

herein by reference. Certain other information relating to the Executive Officers of Honeywell appears

in Part I of this Annual Report on Form 10-K under the heading “Executive Officers of the Registrant”.

The members of the Audit Committee of our Board of Directors are: George Paz (Chair), Kevin

Burke, D. Scott Davis, Linnet Deily, and Judd Gregg. The Board has determined that Mr. Paz is the

“audit committee financial expert” as defined by applicable SEC rules and that Mr. Paz, Mr. Burke, Mr.

Davis, and Ms. Deily satisfy the “accounting or related financial management expertise” criteria

established by the NYSE. All members of the Audit Committee are “independent” as that term is

defined in applicable SEC Rules and NYSE listing standards.

Honeywell’s Code of Business Conduct is available, free of charge, on our website under the

heading “Investor Relations” (see “Corporate Governance”), or by writing to Honeywell, 101 Columbia

Road, Morris Township, New Jersey 07962, c/o Vice President and Corporate Secretary. Honeywell’s

Code of Business Conduct applies to all Honeywell directors, officers (including the Chief Executive

Officer, Chief Financial Officer and Controller) and employees. Amendments to or waivers of the Code

of Business Conduct granted to any of Honeywell’s directors or executive officers will be published on

our website within five business days of such amendment or waiver.

Item 11. Executive Compensation

Information relating to executive compensation is contained in the Proxy Statement referred to

above in “Item 10. Directors and Executive Officers of the Registrant,” and such information is

incorporated herein by reference.

Item 12. Security Ownership of Certain Beneficial Owners and Management

and Related Stockholder Matters

Information relating to security ownership of certain beneficial owners and management and

related stockholder matters is contained in the Proxy Statement referred to above in “Item 10. Directors

and Executive Officers of the Registrant,” and such information is incorporated herein by reference.

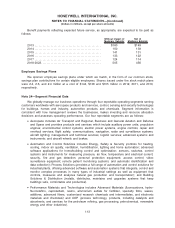

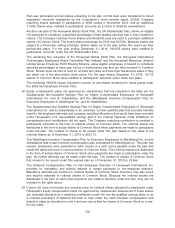

EQUITY COMPENSATION PLANS

As of December 31, 2012 information about our equity compensation plans is as follows:

Plan category

Number of

Shares to be

Issued Upon

Exercise of

Outstanding

Options,

Warrants and

Rights

Weighted-

Average

Exercise Price

of Outstanding

Options,

Warrants and

Rights

Number of

Securities

Remaining

Available for

Future Issuance

Under Equity

Compensation

Plans (Excluding

Securities

Reflected in

Column (a))

(a) (b) (c)

Equity compensation plans approved by security

holders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45,349,354(1) $47.13(2) 35,209,070(3)

Equity compensation plans not approved by security

holders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 594,679(4) N/A(5) N/A(6)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45,944,033 47.13 35,209,070

120