Honeywell 2012 Annual Report Download - page 76

Download and view the complete annual report

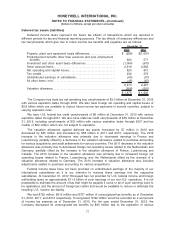

Please find page 76 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In May 2011, the FASB issued amendments to disclosure requirements for common fair value

measurement. These amendments, effective for the interim and annual periods beginning on or after

December 15, 2011 (early adoption is prohibited), result in a common definition of fair value and

common requirements for measurement of and disclosure requirements between U.S. GAAP and

International Financial Reporting Standards. Consequently, the amendments change some fair value

measurement principles and disclosure requirements. The implementation of the amended accounting

guidance has not had a material impact on our consolidated financial position or results of operations.

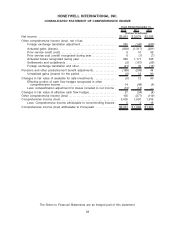

In June 2011, the FASB issued amendments to disclosure requirements for presentation of

comprehensive income. This guidance, effective retrospectively for the interim and annual periods

beginning on or after December 15, 2011 (early adoption is permitted), requires presentation of total

comprehensive income, the components of net income, and the components of other comprehensive

income either in a single continuous statement of comprehensive income or in two separate but

consecutive statements. In December 2011, the FASB issued an amendment to defer the presentation

on the face of the financial statements the effects of reclassifications out of accumulated other

comprehensive income on the components of net income and other comprehensive income for annual

and interim financial statements. The implementation of the amended accounting guidance has not had

a material impact on our consolidated financial position or results of operations. In February 2013, the

FASB issued amendments to disclosure requirements for presentation of comprehensive income. The

standard requires presentation (either in a single note or parenthetically on the face of the financial

statements) of the effect of significant amounts reclassified from each component of accumulated other

comprehensive income based on its source and the income statement line items affected by the

reclassification. If a component is not required to be reclassified to net income in its entirety, a cross

reference to the related footnote for additional information will be required. The amendments are

effective prospectively for reporting periods beginning after December 15, 2012 (early adoption is

permitted). The implementation of the amended accounting guidance is not expected to have a

material impact on our consolidated financial position or results of operations.

In September 2011, the FASB issued amendments to the goodwill impairment guidance which

provides an option for companies to use a qualitative approach to test goodwill for impairment if certain

conditions are met. The amendments are effective for annual and interim goodwill impairment tests

performed for fiscal years beginning after December 15, 2011 (early adoption is permitted). The

implementation of the amended accounting guidance has not had a material impact on our

consolidated financial position or results of operations.

In July 2012, the FASB issued amendments to the indefinite-lived intangible asset impairment

guidance which provides an option for companies to use a qualitative approach to test indefinite-lived

intangible assets for impairment if certain conditions are met. The amendments are effective for annual

and interim indefinite-lived intangible asset impairment tests performed for fiscal years beginning after

September 15, 2012 (early adoption is permitted). The implementation of the amended accounting

guidance is not expected to have a material impact on our consolidated financial position or results of

operations.

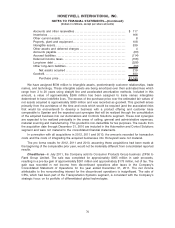

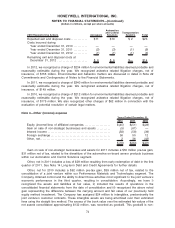

Note 2—Acquisitions and Divestitures

Acquisitions—We acquired businesses for an aggregate cost (net of cash acquired) of $438,

$973, and $1,303 million in 2012, 2011 and 2010, respectively. For all of our acquisitions the acquired

businesses were recorded at their estimated fair values at the dates of acquisition. Significant

acquisitions made in these years are discussed below.

In December 2012, the Company entered into a definitive agreement to acquire Intermec, Inc.

(Intermec) a leading provider of mobile computing, radio frequency identification solutions (RFID) and

bar code, label and receipt printers for use in warehousing, supply chain, field service and

manufacturing environments for $10 per share in cash, or an aggregate purchase price of

67

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)