Honeywell 2012 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.government programs which impact us (OEM production, engineering development programs,

aftermarket spares and repairs and overhaul programs), increases in direct foreign defense and

space market sales, as well as our diversified commercial businesses. Our contracts with the U.S.

Government are subject to audits, investigations, and termination by the government. See “Item 1A.

Risk Factors.”

Backlog

Our total backlog at December 31, 2012 and 2011 was $16,807 and $16,160 million, respectively.

We anticipate that approximately $12,102 million of the 2012 backlog will be filled in 2013. We believe

that backlog is not necessarily a reliable indicator of our future sales because a substantial portion of

the orders constituting this backlog may be canceled at the customer’s option.

Competition

We are subject to active competition in substantially all product and service areas. Competition is

expected to continue in all geographic regions. Competitive conditions vary widely among the

thousands of products and services provided by us, and vary by country. Our businesses compete on

a variety of factors, such as price, quality, reliability, delivery, customer service, performance, applied

technology, product innovation and product recognition. Brand identity, service to customers and

quality are important competitive factors for our products and services, and there is considerable price

competition. Other competitive factors include breadth of product line, research and development

efforts and technical and managerial capability. While our competitive position varies among our

products and services, we believe we are a significant competitor in each of our major product and

service classes. A number of our products and services are sold in competition with those of a large

number of other companies, some of which have substantial financial resources and significant

technological capabilities. In addition, some of our products compete with the captive component

divisions of original equipment manufacturers. See Item 1A “Risk Factors” for further discussion.

International Operations

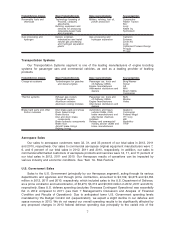

We are engaged in manufacturing, sales, service and research and development globally. U.S.

exports and foreign manufactured products are significant to our operations. U.S. exports comprised

14, 12 and 11 percent of our total sales in 2012, 2011 and 2010, respectively. Foreign manufactured

products and services, mainly in Europe and Asia, were 41, 43 and 42 percent of our total sales in

2012, 2011 and 2010, respectively.

Approximately 20 percent of total 2012 sales of Aerospace-related products and services were

exports of U.S. manufactured products and systems and performance of services such as aircraft

repair and overhaul. Exports were principally made to Europe, Canada, Asia and Latin America.

Foreign manufactured products and systems and performance of services comprised approximately 16

percent of total 2012 Aerospace sales. The principal manufacturing facilities outside the U.S. are in

Europe, with less significant operations in Canada and Asia.

Approximately 3 percent of total 2012 sales of Automation and Control Solutions products and

services were exports of U.S. manufactured products. Foreign manufactured products and

performance of services accounted for 57 percent of total 2012 Automation and Control Solutions

sales. The principal manufacturing facilities outside the U.S. are in Europe and Asia, with less

significant operations in Canada and Australia.

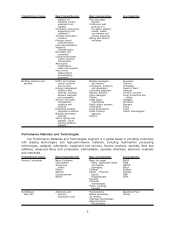

Approximately 35 percent of total 2012 sales of Performance Materials and Technologies products

and services were exports of U.S. manufactured products. Exports were principally made to Asia and

Latin America. Foreign manufactured products and performance of services comprised 22 percent of

total 2012 Performance Materials and Technologies sales. The principal manufacturing facilities

outside the U.S. are in Europe, with less significant operations in Asia.

Approximately 3 percent of total 2012 sales of Transportation Systems products were exports of

U.S. manufactured products. Foreign manufactured products accounted for 83 percent of total 2012

8