Honeywell 2012 Annual Report Download - page 75

Download and view the complete annual report

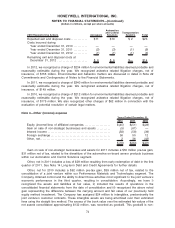

Please find page 75 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At times we also transfer trade and other receivables that qualify as a sale and are thus are

removed from the Consolidated Balance Sheet at the time they are sold. The value assigned to any

subordinated interests and undivided interests retained in receivables sold is based on the relative fair

values of the interests retained and sold. The carrying value of the retained interests approximates fair

value due to the short-term nature of the collection period for the receivables.

Income Taxes—Deferred tax liabilities or assets reflect temporary differences between amounts

of assets and liabilities for financial and tax reporting. Such amounts are adjusted, as appropriate, to

reflect changes in tax rates expected to be in effect when the temporary differences reverse. A

valuation allowance is established to offset any deferred tax assets if, based upon the available

evidence, it is more likely than not that some or all of the deferred tax assets will not be realized. The

determination of the amount of a valuation allowance to be provided on recorded deferred tax assets

involves estimates regarding (1) the timing and amount of the reversal of taxable temporary

differences, (2) expected future taxable income, and (3) the impact of tax planning strategies. In

assessing the need for a valuation allowance, we consider all available positive and negative evidence,

including past operating results, projections of future taxable income and the feasibility of ongoing tax

planning strategies. The projections of future taxable income include a number of estimates and

assumptions regarding our volume, pricing and costs. Additionally, valuation allowances related to

deferred tax assets can be impacted by changes to tax laws.

Significant judgment is required in determining income tax provisions and in evaluating tax

positions. We establish additional reserves for income taxes when, despite the belief that tax positions

are fully supportable, there remain certain positions that do not meet the minimum recognition

threshold. The approach for evaluating certain and uncertain tax positions is defined by the

authoritative guidance and this guidance determines when a tax position is more likely than not to be

sustained upon examination by the applicable taxing authority. In the normal course of business, the

tax filings of the Company and its subsidiaries are examined by various Federal, State and foreign tax

authorities. We regularly assess the potential outcomes of these examinations and any future

examinations for the current or prior years in determining the adequacy of our provision for income

taxes. We continually assess the likelihood and amount of potential adjustments and adjust the income

tax provision, the current tax liability and deferred taxes in the period in which the facts that give rise to

a change in estimate become known.

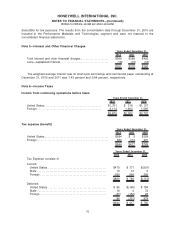

Earnings Per Share—Basic earnings per share is based on the weighted average number of

common shares outstanding. Diluted earnings per share is based on the weighted average number of

common shares outstanding and all dilutive potential common shares outstanding.

Use of Estimates—The preparation of consolidated financial statements in conformity with

generally accepted accounting principles requires management to make estimates and assumptions

that affect the reported amounts in the financial statements and related disclosures in the

accompanying notes. Actual results could differ from those estimates. Estimates and assumptions

are periodically reviewed and the effects of revisions are reflected in the consolidated financial

statements in the period they are determined to be necessary.

Reclassifications—Certain prior year amounts have been reclassified to conform to the current

year presentation.

Recent Accounting Pronouncements—Changes to accounting principles generally accepted in

the United States of America (U.S. GAAP) are established by the Financial Accounting Standards

Board (FASB) in the form of accounting standards updates (ASU’s) to the FASB’s Accounting

Standards Codification.

The Company considers the applicability and impact of all ASU’s. ASU’s not listed below were

assessed and determined to be either not applicable or are expected to have minimal impact on our

consolidated financial position and results of operations.

66

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)