Honeywell 2012 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

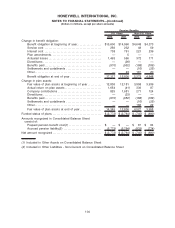

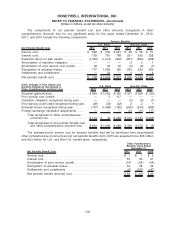

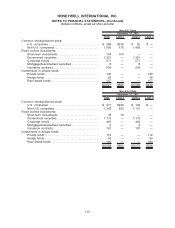

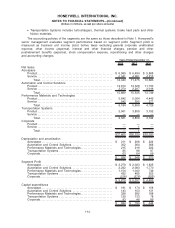

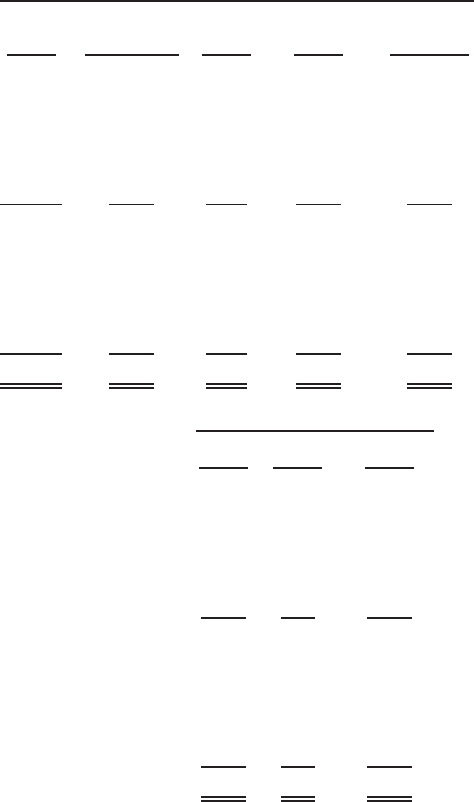

The following tables summarize changes in the fair value of Level 3 assets for the years ended

December 31, 2012 and 2011:

Private

Funds

Direct

Private

Investments

Hedge

Funds

Real Estate

Funds

Real Estate

Properties

U.S. Plans

Balance at December 31, 2010. . . . . . . . . . . . . . $1,053 $167 $ 77 $214 $494

Actual return on plan assets:

Relating to assets still held at year-end . . (9) 4 (7) 26 41

Relating to assets sold during the year . . — 8 4 — —

Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 163 31 13 48 19

Sales and settlements. . . . . . . . . . . . . . . . . . . . . . . (168) (49) (27) (32) (1)

Balance at December 31, 2011. . . . . . . . . . . . . . 1,039 161 60 256 553

Actual return on plan assets:

Relating to assets still held at year-end . . 44 12 11 16 29

Relating to assets sold during the year . . (1) 6 1 (1) —

Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 147 65 4 31 41

Sales and settlements. . . . . . . . . . . . . . . . . . . . . . . (129) (17) (24) (48) (28)

Balance at December 31, 2012. . . . . . . . . . . . . . $1,100 $227 $ 52 $254 $595

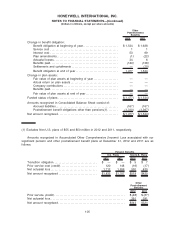

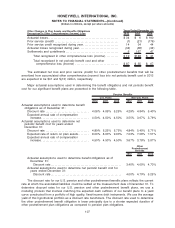

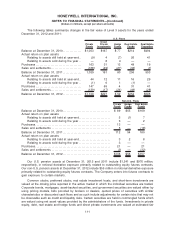

Private

Funds

Hedge

Funds

Real Estate

Funds

Non-U.S. Plans

Balance at December 31, 2010. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 89 $55 $169

Actual return on plan assets:

Relating to assets still held at year-end. . . . . . . . . . . . . . . . . . . . . . . 2 (1) 7

Relating to assets sold during the year . . . . . . . . . . . . . . . . . . . . . . . 3 — 2

Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 — —

Sales and settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 — (18)

Balance at December 31, 2011. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 112 54 160

Actual return on plan assets:

Relating to assets still held at year-end. . . . . . . . . . . . . . . . . . . . . . . 3 2 8

Relating to assets sold during the year . . . . . . . . . . . . . . . . . . . . . . . 3 — —

Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 — 21

Sales and settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3) — (32)

Balance at December 31, 2012. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $136 $56 $157

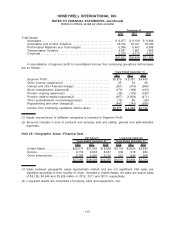

Our U.S. pension assets at December 31, 2012 and 2011 include $1,241 and $976 million,

respectively, in notional derivative exposure primarily related to outstanding equity futures contracts.

Our non-U.S. pension assets at December 31, 2012 include $55 million in notional derivative exposure

primarily related to outstanding equity futures contracts. The Company enters into futures contracts to

gain exposure to certain markets.

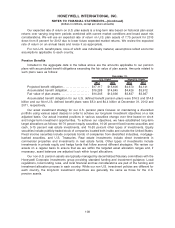

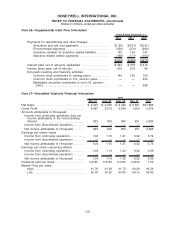

Common stocks, preferred stocks, real estate investment trusts, and short-term investments are

valued at the closing price reported in the active market in which the individual securities are traded.

Corporate bonds, mortgages, asset-backed securities, and government securities are valued either by

using pricing models, bids provided by brokers or dealers, quoted prices of securities with similar

characteristics or discounted cash flows and as such include adjustments for certain risks that may not

be observable such as credit and liquidity risks. Certain securities are held in commingled funds which

are valued using net asset values provided by the administrators of the funds. Investments in private

equity, debt, real estate and hedge funds and direct private investments are valued at estimated fair

111

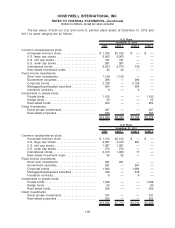

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)