Honeywell 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

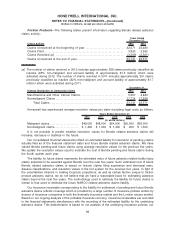

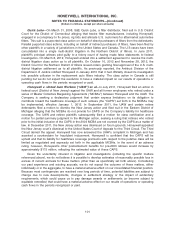

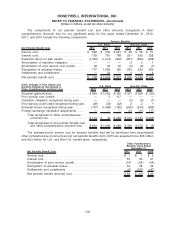

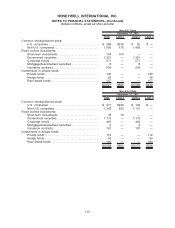

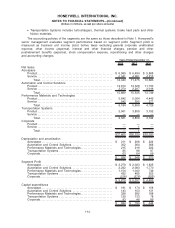

Other Changes in Plan Assets and Benefits Obligations

Recognized in Other Comprehensive (Income) Loss 2012 2011 2010

Years Ended December 31,

Actuarial losses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 34 $ 6 $ 160

Prior service (credit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1) (21) (176)

Prior service credit recognized during year . . . . . . . . . . . . . . . . . . . . . . . . . . 14 34 44

Actuarial losses recognized during year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (34) (38) (34)

Settlements and curtailments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 167 47

Total recognized in other comprehensive loss (income). . . . . . . . . . $ 19 $148 $ 41

Total recognized in net periodic benefit cost and other

comprehensive loss (income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 87 $ 55 $ 67

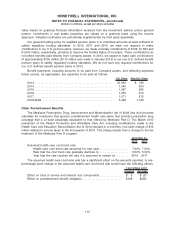

The estimated net loss and prior service (credit) for other postretirement benefits that will be

amortized from accumulated other comprehensive (income) loss into net periodic benefit cost in 2013

are expected to be $41 and $(13) million, respectively.

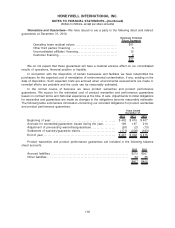

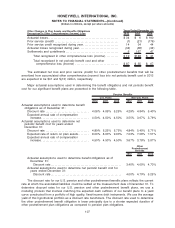

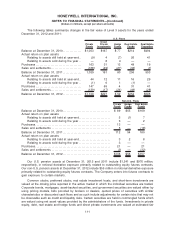

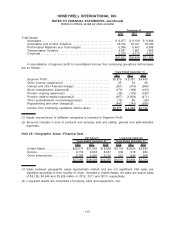

Major actuarial assumptions used in determining the benefit obligations and net periodic benefit

cost for our significant benefit plans are presented in the following table.

2012 2011 2010 2012 2011 2010

U.S. Plans Non-U.S. Plans

Pension Benefits

Actuarial assumptions used to determine benefit

obligations as of December 31:

Discount rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.06% 4.89% 5.25% 4.29% 4.84% 5.40%

Expected annual rate of compensation

increase . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.50% 4.50% 4.50% 3.55% 3.67% 3.79%

Actuarial assumptions used to determine net

periodic benefit cost for years ended

December 31:

Discount rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.89% 5.25% 5.75% 4.84% 5.40% 5.71%

Expected rate of return on plan assets. . . . . . . . 8.00% 8.00% 9.00% 7.03% 7.06% 7.51%

Expected annual rate of compensation

increase . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.50% 4.50% 4.50% 3.67% 3.79% 3.87%

2012 2011 2010

Other

Postretirement

Benefits

Actuarial assumptions used to determine benefit obligations as of

December 31:

Discount rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.40% 4.00% 4.70%

Actuarial assumptions used to determine net periodic benefit cost for

years ended December 31:

Discount rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.00% 4.70% 5.25%

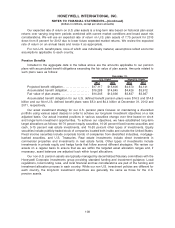

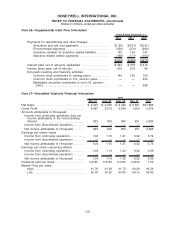

The discount rate for our U.S. pension and other postretirement benefits plans reflects the current

rate at which the associated liabilities could be settled at the measurement date of December 31. To

determine discount rates for our U.S. pension and other postretirement benefit plans, we use a

modeling process that involves matching the expected cash outflows of our benefit plans to a yield

curve constructed from a portfolio of high quality, fixed-income debt instruments. We use the average

yield of this hypothetical portfolio as a discount rate benchmark. The discount rate used to determine

the other postretirement benefit obligation is lower principally due to a shorter expected duration of

other postretirement plan obligations as compared to pension plan obligations.

107

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)