Honeywell 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.slowing global demand and lower prices resulting from increased availability of refrigerants

supply.

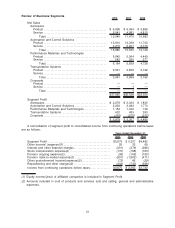

PMT segment profit increased by 39 percent in 2011 compared with 2010 due to a 38 percent

increase in operational segment profit and a 1 percent favorable impact of foreign exchange. The

increase in operational segment profit is primarily due to the favorable price to raw materials spread in

Resins and Chemicals and Fluorine Products and higher service, product and licensing revenues in

UOP, partially offset by continued investment in growth and plant optimization initiatives. Cost of

products and services sold totaled $4.2 billion in 2011, an increase of approximately $597 million which

is primarily due to volume, material inflation, the phenol plant acquisition and continued investment in

growth initiatives.

2013 Areas of Focus

Performance Materials and Technologies primary areas of focus for 2013 include:

•Continuing to develop new processes, products and technologies that address energy efficiency,

the environment and security, as well as position the portfolio for higher value;

•Commercializing new products and technologies in the petrochemical, gas processing and

refining industries and renewable energy sector;

•Investing to increase plant capacity and reliability to service backlog and improve productivity

and quality through operational excellence;

•Driving sales and marketing excellence and expanding local presence in high growth regions;

•Managing exposure to raw material price and supply fluctuations through evaluation of

alternative sources of supply and contractual arrangements; and

•Managing the successful integration of acquisitions related to our gas processing and hydrogen

business unit including capacity and geographic expansion to address rapidly growing

commercial opportunities and existing backlog.

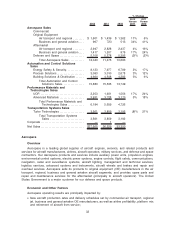

Transportation Systems

Overview

Transportation Systems provides automotive products that improve the performance and

efficiency of cars, trucks, and other vehicles through state-of-the-art technologies, world class brands

and global solutions to customers’ needs. Transportation Systems’ products include turbochargers and

thermal systems; and friction materials (Bendix(R) and Jurid(R)) and brake hard parts. Transportation

Systems sells its products to original equipment (“OE”) automotive and truck manufacturers

(e.g., BMW, Caterpillar, Daimler, Renault, Ford, and Volkswagen), wholesalers and distributors and

through the retail aftermarket.

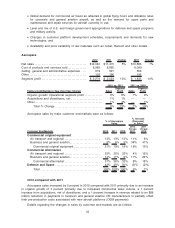

Economic and Other Factors

Transportation Systems operating results are principally impacted by:

•Financial strength and stability of automotive OE manufacturers;

•Global demand, particularly in Western Europe, for automobile and truck production;

•Turbo penetration rates for new engine platforms;

•Global consumer preferences, particularly in Western Europe, for boosted diesel passenger

cars;

•Degree of volatility in raw material prices, including nickel and steel;

•New automobile production rates and the impact of inventory levels of automotive OE

manufacturers on demand for our products;

•Regulations mandating lower emissions and improved fuel economy;

40