Honeywell 2012 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

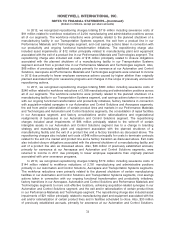

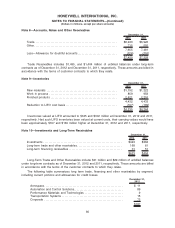

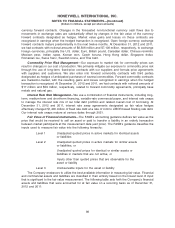

Allowance for credit losses for the above detailed long-term trade, financing and other receivables

totaled $4 million and $5 million as of December 31, 2012 and 2011, respectively. The receivables are

evaluated for recoverability on an individual basis, including consideration of credit quality. The above

detailed financing receivables are predominately with commercial and governmental counterparties of

investment grade credit quality.

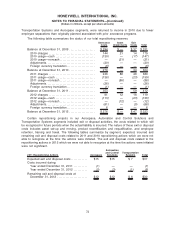

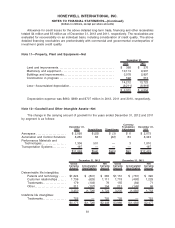

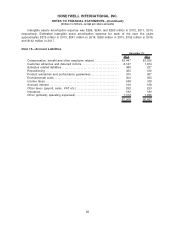

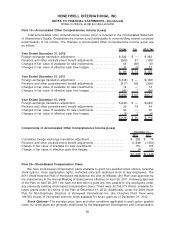

Note 11—Property, Plant and Equipment—Net

2012 2011

December 31,

Land and improvements. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 368 $ 376

Machinery and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,174 9,937

Buildings and improvements. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,078 2,897

Construction in progress . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 592 513

14,212 13,723

Less—Accumulated depreciation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9,211) (8,919)

$ 5,001 $ 4,804

Depreciation expense was $660, $699 and $707 million in 2012, 2011 and 2010, respectively.

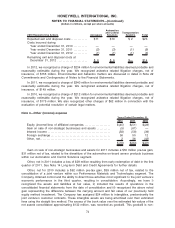

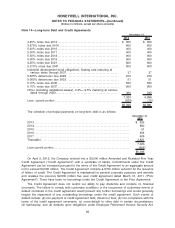

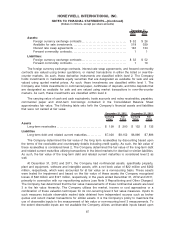

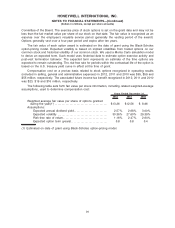

Note 12—Goodwill and Other Intangible Assets—Net

The change in the carrying amount of goodwill for the years ended December 31, 2012 and 2011

by segment is as follows:

December 31,

2011 Acquisitions Divestitures

Currency

Translation

Adjustment

December 31,

2012

Aerospace . . . . . . . . . . . . . . . . . . . . . . $ 2,095 $ (23) $ (3) $ 6 $ 2,075

Automation and Control Solutions 8,260 62 (62) 83 8,343

Performance Materials and

Technologies. . . . . . . . . . . . . . . . . . 1,306 501 — 3 1,810

Transportation Systems. . . . . . . . . . 197 — — — 197

$11,858 $540 $(65) $92 $12,425

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

December 31, 2012 December 31, 2011

Determinable life intangibles:

Patents and technology . . . . . $1,224 $ (841) $ 383 $1,151 $ (761) $ 390

Customer relationships . . . . . . 1,736 (625) 1,111 1,718 (493) 1,225

Trademarks. . . . . . . . . . . . . . . . . 179 (103) 76 155 (84) 71

Other. . . . . . . . . . . . . . . . . . . . . . . 311 (157) 154 211 (145) 66

3,450 (1,726) 1,724 3,235 (1,483) 1,752

Indefinite life intangibles:

Trademarks. . . . . . . . . . . . . . . . . 725 — 725 725 — 725

$4,175 $(1,726) $2,449 $3,960 $(1,483) $2,477

81

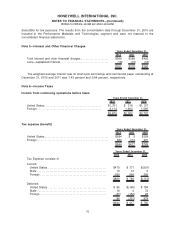

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)