Honeywell 2012 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

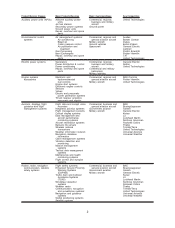

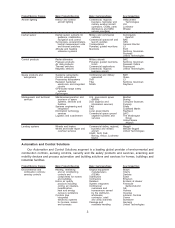

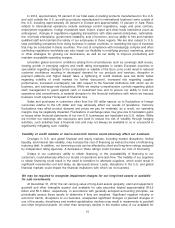

Product/Service Classes Major Products/Services Major Customers/Uses Key Competitors

Renewable fuels and

chemicals

Technology licensing of

Process, catalysts,

absorbents,

Refining equipment and

services for producing

renewable-based fuels

and chemicals

Military, refining, fuel oil,

power production

Dynamotive

Haldor Topsoe

Kior

Lurgi

Neste Oy

Syntroleum

Gas processing and

hydrogen

Design, engineer,

manufacture and install

natural gas processing

and hydrogen separation

plants

Gas processing and

hydrogen separation

Cameron

Exterran

Linde AG

Lurgi

Optimized Process Design

Proquip

Prosep

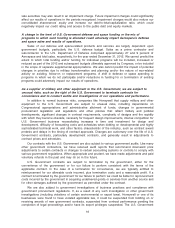

Transportation Systems

Our Transportation Systems segment is one of the leading manufacturers of engine boosting

systems for passenger cars and commercial vehicles, as well as a leading provider of braking

products.

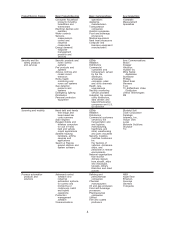

Product/Service Classes Major Products/Services Major Customers/Uses Key Competitors

Charge-air systems Turbochargers for gasoline

and diesel engines

Passenger car, truck and

off-highway OEMs

Engine manufacturers

Aftermarket distributors and

dealers

Borg-Warner

Holset

IHI

MHI

Bosch Mahle

Continental

Thermal systems Exhaust gas coolers

Charge-air coolers

Aluminum radiators

Aluminum cooling modules

Passenger car, truck and

off-highway OEMs

Engine manufacturers

Aftermarket distributors and

dealers

Behr

Modine

Valeo

Brake hard parts and other

friction materials

Disc brake pads and shoes

Drum brake linings

Brake blocks

Disc and drum brake

components

Brake hydraulic components

Brake fluid

Aircraft brake linings

Railway linings

Automotive and heavy

vehicle OEMs, OES,

brake manufacturers and

aftermarket channels

Installers

Railway and commercial/

military aircraft OEMs and

brake manufacturers

Akebono

Continental

Federal-Mogul

ITT Corp

JBI

Nisshinbo

TRW

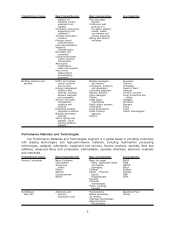

Aerospace Sales

Our sales to aerospace customers were 32, 31, and 33 percent of our total sales in 2012, 2011

and 2010, respectively. Our sales to commercial aerospace original equipment manufacturers were 7,

6, and 6 percent of our total sales in 2012, 2011 and 2010, respectively. In addition, our sales to

commercial aftermarket customers of aerospace products and services were 12, 11, and 11 percent of

our total sales in 2012, 2011 and 2010. Our Aerospace results of operations can be impacted by

various industry and economic conditions. See “Item 1A. Risk Factors.”

U.S. Government Sales

Sales to the U.S. Government (principally by our Aerospace segment), acting through its various

departments and agencies and through prime contractors, amounted to $4,109, $4,276 and $4,354

million in 2012, 2011 and 2010, respectively, which included sales to the U.S. Department of Defense,

as a prime contractor and subcontractor, of $3,273, $3,374 and $3,500 million in 2012, 2011 and 2010,

respectively. Base U.S. defense spending (excludes Overseas Contingent Operations) was essentially

flat in 2012 compared to 2011 (see Item 7 Management’s Discussion and Analysis of Financial

Condition and Results of Operations). Due to anticipated lower U.S. Government spending levels

mandated by the Budget Control Act (sequestration), we expect a slight decline in our defense and

space revenue in 2013. We do not expect our overall operating results to be significantly affected by

any proposed changes in 2013 federal defense spending due principally to the varied mix of the

7