Honeywell 2012 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.automobiles and trucks equipped with turbochargers, and regulatory changes regarding automobile

and truck emissions and fuel economy, delays in launch schedules for new automotive platforms, and

consumer demand and spending for automotive aftermarket products. Demand of global automotive

and truck manufacturers will continue to be influenced by a wide variety of factors, including ability of

consumers to obtain financing, ability to reduce operating costs and overall consumer and business

confidence. Each of the segments is impacted by volatility in raw material prices (as further described

below) and non-material inflation.

Raw material price fluctuations, the ability of key suppliers to meet quality and delivery

requirements, or catastrophic events can increase the cost of our products and services,

impact our ability to meet commitments to customers and cause us to incur significant

liabilities.

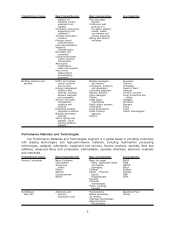

The cost of raw materials is a key element in the cost of our products, particularly in our

Performance Materials and Technologies (cumene, fluorspar, perchloroethylene, R240, natural gas,

sulfur and ethylene), Transportation Systems (nickel, steel and other metals) and Aerospace (nickel,

titanium and other metals) segments. Our inability to offset material price inflation through increased

prices to customers, formula or long-term fixed price contracts with suppliers, productivity actions or

through commodity hedges could adversely affect our results of operations.

Our manufacturing operations are also highly dependent upon the delivery of materials (including

raw materials) by outside suppliers and their assembly of major components, and subsystems used in

our products in a timely manner and in full compliance with purchase order terms and conditions,

quality standards, and applicable laws and regulations. In addition, many major components, product

equipment items and raw materials are procured or subcontracted on a single-source basis with a

number of domestic and foreign companies; in some circumstances these suppliers are the sole

source of the component or equipment. Although we maintain a qualification and performance

surveillance process to control risk associated with such reliance on third parties and we believe that

sources of supply for raw materials and components are generally adequate, it is difficult to predict

what effects shortages or price increases may have in the future. Our ability to manage inventory and

meet delivery requirements may be constrained by our suppliers’ inability to scale production and

adjust delivery of long-lead time products during times of volatile demand. Our suppliers may fail to

perform according to specifications as and when required and we may be unable to identify alternate

suppliers or to otherwise mitigate the consequences of their non-performance. The supply chains for

our businesses could also be disrupted by suppliers’ decisions to exit certain businesses, bankruptcy

and by external events such as natural disasters, extreme weather events, pandemic health issues,

terrorist actions, labor disputes, governmental actions and legislative or regulatory changes

(e.g., product certification or stewardship requirements, sourcing restrictions, product authenticity,

climate change or greenhouse gas emission standards, etc.). Our inability to fill our supply needs

would jeopardize our ability to fulfill obligations under commercial and government contracts, which

could, in turn, result in reduced sales and profits, contract penalties or terminations, and damage to

customer relationships. Transitions to new suppliers may result in significant costs and delays,

including those related to the required recertification of parts obtained from new suppliers with our

customers and/or regulatory agencies. In addition, because our businesses cannot always immediately

adapt their cost structure to changing market conditions, our manufacturing capacity for certain

products may at times exceed or fall short of our production requirements, which could adversely

impact our operating costs, profitability and customer and supplier relationships.

Our facilities, distribution systems and information technology systems are subject to catastrophic

loss due to, among other things, fire, flood, terrorism or other natural or man-made disasters. If any of

these facilities or systems were to experience a catastrophic loss, it could disrupt our operations, result

in personal injury or property damage, damage relationships with our customers and result in large

expenses to repair or replace the facilities or systems, as well as result in other liabilities and adverse

impacts. The same risk could also arise from the failure of critical systems supplied by Honeywell to

large industrial, refining and petrochemical customers.

13