Honeywell 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 1—Summary of Significant Accounting Policies

Accounting Principles—The financial statements and accompanying notes are prepared in

accordance with accounting principles generally accepted in the United States of America. The

following is a description of Honeywell’s significant accounting policies.

Principles of Consolidation—The consolidated financial statements include the accounts of

Honeywell International Inc. and all of its subsidiaries and entities in which a controlling interest is

maintained. Our consolidation policy requires equity investments that we exercise significant influence

over but do not control the investee and are not the primary beneficiary of the investee’s activities to be

accounted for using the equity method. Investments through which we are not able to exercise

significant influence over the investee and which we do not have readily determinable fair values are

accounted for under the cost method. All intercompany transactions and balances are eliminated in

consolidation.

The Consumer Products Group (CPG) automotive aftermarket business had historically been part

of the Transportation Systems reportable segment. In accordance with generally accepted accounting

principles, CPG is presented as discontinued operations in all periods presented. See Note 2

Acquisitions and Divestitures for further details.

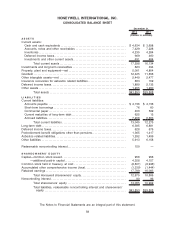

Noncontrolling interest is included within the equity section in the Consolidated Balance Sheet.

Redeemable noncontrolling interest is considered to be temporary equity and is therefore reported

outside of permanent equity on the Company’s Consolidated Balance Sheet at the greater of the initial

carrying amount adjusted for the noncontrolling interest’s share of net income (loss) or its redemption

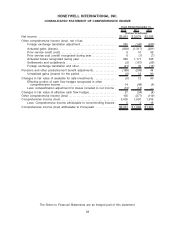

value. We present the amount of consolidated net income that is attributable to Honeywell and the

noncontrolling interest in the Consolidated Statement of Operations. Furthermore, we disclose the

amount of comprehensive income that is attributable to Honeywell and the noncontrolling interest in the

Consolidated Statement of Comprehensive Income.

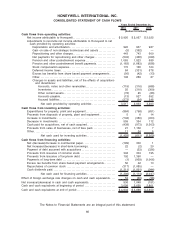

Cash and Cash Equivalents—Cash and cash equivalents include cash on hand and on deposit

and highly liquid, temporary cash investments with an original maturity of three months or less.

Inventories—Inventories are valued at the lower of cost or market using the first-in, first-out or the

average cost method and the last-in, first-out (LIFO) method for certain qualifying domestic inventories.

Investments—Investments in affiliates over which we have a significant influence, but not a

controlling interest, are accounted for using the equity method of accounting. Other investments are

carried at market value, if readily determinable, or at cost. All equity investments are periodically

reviewed to determine if declines in fair value below cost basis are other-than-temporary. Significant

and sustained decreases in quoted market prices or a series of historic and projected operating losses

by investees are strong indicators of other-than-temporary declines. If the decline in fair value is

determined to be other-than-temporary, an impairment loss is recorded and the investment is written

down to a new carrying value.

Property, Plant and Equipment—Property, plant and equipment are recorded at cost, including

any asset retirement obligations, less accumulated depreciation. For financial reporting, the straight-

line method of depreciation is used over the estimated useful lives of 10 to 50 years for buildings and

improvements and 2 to 16 years for machinery and equipment. Recognition of the fair value of

obligations associated with the retirement of tangible long-lived assets is required when there is a legal

obligation to incur such costs. Upon initial recognition of a liability, the cost is capitalized as part of the

related long-lived asset and depreciated over the corresponding asset’s useful life. See Note 11

Property, Plant and Equipment - Net and Note 17 Other Liabilities of Notes to the Financial Statements

for additional details.

Goodwill and Indefinite-Lived Intangible Assets—Goodwill represents the excess of acquisition

costs over the fair value of tangible net assets and identifiable intangible assets of businesses

acquired. Goodwill and certain other intangible assets deemed to have indefinite lives are not

62

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS

(Dollars in millions, except per share amounts)