Honeywell 2012 Annual Report Download - page 74

Download and view the complete annual report

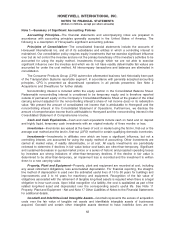

Please find page 74 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the Financial Statements, include non-qualified stock options and restricted stock units (RSUs). The

cost for such awards is measured at the grant date based on the fair value of the award. The value of

the portion of the award that is ultimately expected to vest is recognized as expense over the requisite

service periods (generally the vesting period of the equity award) and is included in selling, general and

administrative expense in our Consolidated Statement of Operations. Forfeitures are required to be

estimated at the time of grant in order to estimate the portion of the award that will ultimately vest. The

estimate is based on our historical rates of forfeiture.

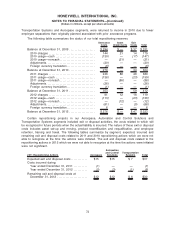

Pension Benefits—We sponsor both funded and unfunded U.S. and non-U.S. defined benefit

pension plans covering the majority of our employees and retirees. We recognize net actuarial gains or

losses in excess of 10 percent of the greater of the market-related value of plan assets or the plans’

projected benefit obligation (the corridor) annually in the fourth quarter each year (MTM Adjustment),

and, if applicable, in any quarter in which an interim remeasurement is triggered. The remaining

components of pension expense, primarily service and interest costs and assumed return on plan

assets, are recorded on a quarterly basis (Pension ongoing income/expense).

Foreign Currency Translation—Assets and liabilities of subsidiaries operating outside the United

States with a functional currency other than U.S. dollars are translated into U.S. dollars using year-end

exchange rates. Sales, costs and expenses are translated at the average exchange rates in effect

during the year. Foreign currency translation gains and losses are included as a component of

Accumulated Other Comprehensive Income (Loss). For subsidiaries operating in highly inflationary

environments, inventories and property, plant and equipment, including related expenses, are

remeasured at the exchange rate in effect on the date the assets were acquired, while monetary

assets and liabilities are remeasured at year-end exchange rates. Remeasurement adjustments for

these subsidiaries are included in earnings.

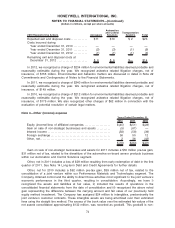

Derivative Financial Instruments—As a result of our global operating and financing activities, we

are exposed to market risks from changes in interest and foreign currency exchange rates and

commodity prices, which may adversely affect our operating results and financial position. We

minimize our risks from interest and foreign currency exchange rate and commodity price fluctuations

through our normal operating and financing activities and, when deemed appropriate through the use

of derivative financial instruments. Derivative financial instruments are used to manage risk and are not

used for trading or other speculative purposes and we do not use leveraged derivative financial

instruments. Derivative financial instruments used for hedging purposes must be designated and

effective as a hedge of the identified risk exposure at the inception of the contract. Accordingly,

changes in fair value of the derivative contract must be highly correlated with changes in fair value of

the underlying hedged item at inception of the hedge and over the life of the hedge contract.

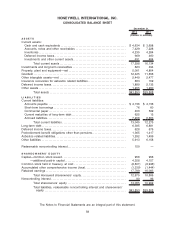

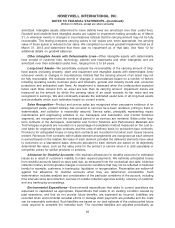

All derivatives are recorded on the balance sheet as assets or liabilities and measured at fair

value. For derivatives designated as hedges of the fair value of assets or liabilities, the changes in fair

values of both the derivatives and the hedged items are recorded in current earnings. For derivatives

designated as cash flow hedges, the effective portion of the changes in fair value of the derivatives are

recorded in Accumulated Other Comprehensive Income (Loss) and subsequently recognized in

earnings when the hedged items impact earnings. Cash flows of such derivative financial instruments

are classified consistent with the underlying hedged item.

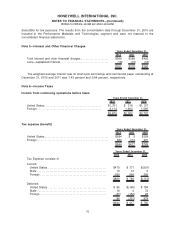

Transfers of Financial Instruments—Sales, transfers and securitization of financial instruments

are accounted for under authoritative guidance for the transfers and servicing of financial assets and

extinguishments of liabilities.

We sell interests in designated pools of trade accounts receivables to third parties. The terms of

the trade accounts receivable program permit the repurchase of receivables from the third parties at

our discretion. As a result, these program receivables are not accounted for as a sale and remain on

the Consolidated Balance Sheet with a corresponding amount recorded as Short-term borrowings.

65

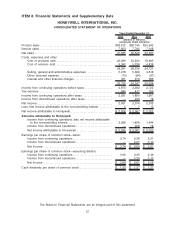

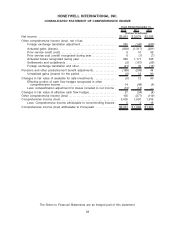

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)