Honeywell 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

sold), lower repositioning actions (approximately 0.6 percentage point impact) and higher segment

gross margin in our Aerospace, Automation and Control Solutions and Performance Materials and

Technologies segments (approximately 0.4 percentage point impact collectively), partially offset by

higher other postretirement expense (approximately 0.4 percentage point impact).

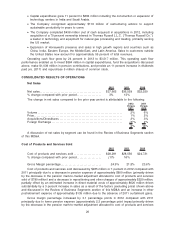

Cost of products and services sold increased by $3,835 million or 16 percent in 2011 compared

with 2010, principally due to an estimated increase in direct material costs, labor costs and indirect

costs of approximately $2 billion, $520 million, and $280 million, respectively, driven substantially by a

13 percent increase in sales as a result of the factors (excluding price) shown above and discussed in

the Review of Business Segments section of this MD&A, an increase in pension and other

postretirement expense of approximately $880 million (primarily driven by the increase in the pension

mark-to-market adjustment allocated to cost of products and services sold of $1.1 billion) and an

increase in repositioning and other charges of approximately $90 million.

Gross margin percentage decreased by 1.8 percentage points in 2011 compared with 2010,

primarily due to higher pension and other postretirement expense (approximate 2.8 percentage point

impact primarily driven by an unfavorable 3.3 percentage point impact resulting from the increase in

the pension mark-to-market adjustment allocated to cost of products and services sold) and

repositioning and other charges (approximate 0.2 percentage point impact), partially offset by higher

sales volume driven by each of our business segments (approximate 1.2 percentage point impact).

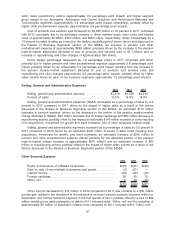

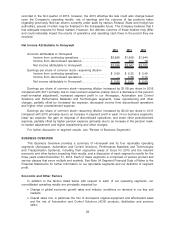

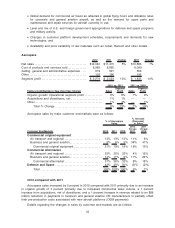

Selling, General and Administrative Expenses

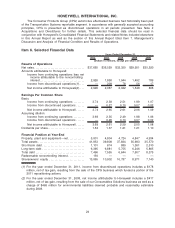

2012 2011 2010

Selling, general and administrative expense. . . . . . . . . . . . . . . . $5,218 $5,399 $4,618

Percent of sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.9% 14.8% 14.3%

Selling, general and administrative expenses (SG&A) decreased as a percentage of sales by 0.9

percent in 2012 compared to 2011 driven by the impact of higher sales as a result of the factors

discussed in the Review of Business Segments section of this MD&A, an estimated $110 million

decrease in pension expense (driven by the decrease in the portion of the pension mark-to-market

charge allocated to SG&A), $90 million decrease due to foreign exchange and $80 million decrease in

repositioning actions, partially offset by the impact an estimated $140 million increase in costs resulting

from acquisitions, investment for growth and merit increases (net of other employee related costs).

Selling, general and administrative expenses increased as a percentage of sales by 0.5 percent in

2011 compared to 2010 driven by an estimated $430 million increase in labor costs resulting from

acquisitions, investment for growth, and merit increases, an estimated increase of $240 million in

pension and other postretirement expense (driven primarily by the allocated portion of the pension

mark-to-market charge increase of approximately $270 million) and an estimated increase of $60

million in repositioning actions, partially offset by the impact of higher sales volume as a result of the

factors discussed in the Review of Business Segments section of this MD&A.

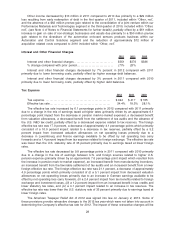

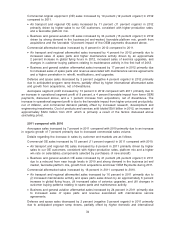

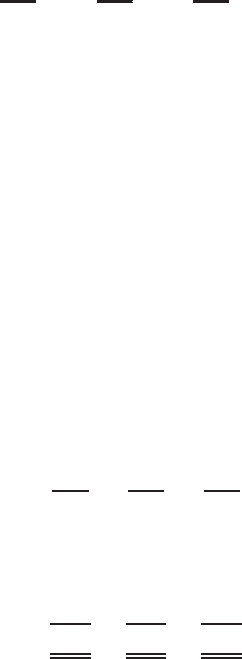

Other (Income) Expense

2012 2011 2010

Equity (income)/loss of affiliated companies. . . . . . . . . . . . . . . . . . . . . . . $(45) $(51) $(28)

Gain on sale of non-strategic businesses and assets . . . . . . . . . . . . . (5) (61) —

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (58) (58) (39)

Foreign exchange . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36 50 12

Other, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 36 (42)

$(70) $(84) $(97)

Other income decreased by $14 million in 2012 compared to 2011 due primarily to a $50 million

pre-tax gain related to the divestiture of the automotive on-board sensors products business within our

Automation and Control Solutions segment in the first quarter of 2011, partially offset by a loss of $29

million resulting from early redemption of debt in 2011 included within “Other, net” and the reduction of

approximately $6 million of acquisition related costs compared to 2011 included within “Other, net”.

27