Honeywell 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

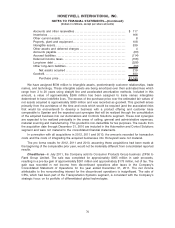

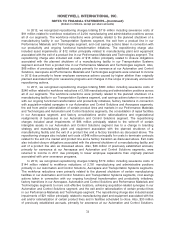

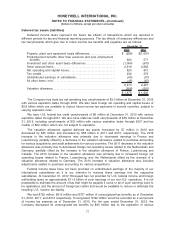

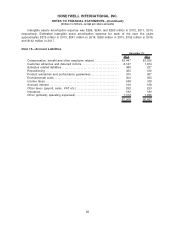

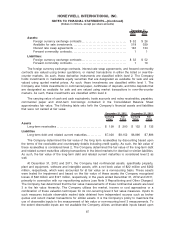

Deferred tax assets (liabilities)

Deferred income taxes represent the future tax effects of transactions which are reported in

different periods for tax and financial reporting purposes. The tax effects of temporary differences and

tax carryforwards which give rise to future income tax benefits and payables are as follows:

2012 2011

December 31,

Property, plant and equipment basis differences. . . . . . . . . . . . . . . . . . . $ (928) $(1,097)

Postretirement benefits other than pensions and post employment

benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 620 571

Investment and other asset basis differences . . . . . . . . . . . . . . . . . . . . . (1,084) (970)

Other accrued items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,918 2,852

Net operating and capital losses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 820 810

Tax credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 232 379

Undistributed earnings of subsidiaries. . . . . . . . . . . . . . . . . . . . . . . . . . . . . (60) (57)

All other items—net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (45) (67)

2,473 2,421

Valuation allowance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (598) (591)

$ 1,875 $ 1,830

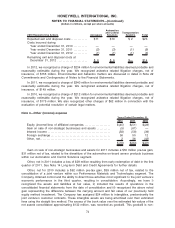

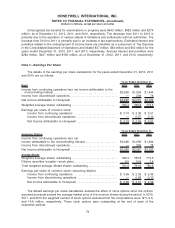

The Company has state tax net operating loss carryforwards of $3.0 billion at December 31, 2012

with various expiration dates through 2030. We also have foreign net operating and capital losses of

$2.8 billion which are available to reduce future income tax payments in several countries, subject to

varying expiration rules.

We have U.S. federal tax credit carryforwards of $6 million at December 31, 2012 with various

expiration dates through 2031. We also have state tax credit carryforwards of $55 million at December

31, 2012, including carryforwards of $33 million with various expiration dates through 2027 and tax

credits of $22 million which are not subject to expiration.

The valuation allowance against deferred tax assets increased by $7 million in 2012 and

decreased by $45 million and increased by $58 million in 2011 and 2010, respectively. The 2012

increase in the valuation allowance was primarily due to decreased earnings in France and

Luxembourg, partially offset by a decrease in the valuation allowance related to purchase accounting

for various acquisitions and audit settlements for various countries. The 2011 decrease in the valuation

allowance was primarily due to decreased foreign net operating losses related to the Netherlands and

Germany, partially offset by the increase in the valuation allowance of France, Luxembourg and

Canada. The 2010 increase in the valuation allowance was primarily due to increased foreign net

operating losses related to France, Luxembourg, and the Netherlands offset by the reversal of a

valuation allowance related to Germany. The 2010 increase in valuation allowance also includes

adjustments related to purchase accounting for various acquisitions.

Federal income taxes have not been provided on undistributed earnings of the majority of our

international subsidiaries as it is our intention to reinvest these earnings into the respective

subsidiaries. At December 31, 2012 Honeywell has not provided for U.S. federal income and foreign

withholding taxes on approximately $11.6 billion of such earnings of our non-U.S. operations. It is not

practicable to estimate the amount of tax that might be payable if some or all of such earnings were to

be repatriated, and the amount of foreign tax credits that would be available to reduce or eliminate the

resulting U.S. income tax liability.

We had $722 million, $815 million and $757 million of unrecognized tax benefits as of December

31, 2012, 2011, and 2010 respectively. If recognized, $722 million would be recorded as a component

of income tax expense as of December 31, 2012. For the year ended December 31, 2012, the

Company decreased its unrecognized tax benefits by $93 million due to the expiration of various

77

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)