Honeywell 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

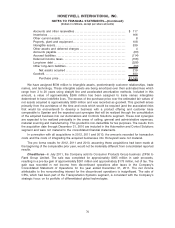

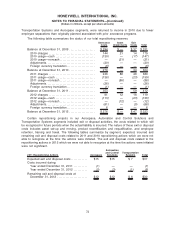

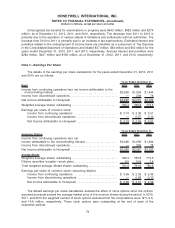

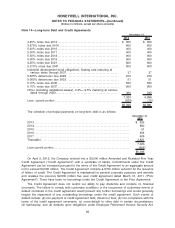

2010 Repositioning Actions Aerospace

Automation

and Control

Solutions

Transportation

Systems Total

Expected exit and disposal costs . . . . . . . . . . . . $11 $10 $ 2 $23

Costs incurred during:

Year ended December 31, 2010 . . . . . . . . . . — — — —

Year ended December 31, 2011 . . . . . . . . . . (2) (3) (1) (6)

Year ended December 31, 2012 . . . . . . . . . . (1) (1) (1) (3)

Remaining exit and disposal costs at

December 31, 2012 . . . . . . . . . . . . . . . . . . . . . . $ 8 $ 6 $— $14

In 2012, we recognized a charge of $234 million for environmental liabilities deemed probable and

reasonably estimable during the year. We recognized asbestos related litigation charges, net of

insurance, of $156 million. Environmental and Asbestos matters are discussed in detail in Note 22

Commitments and Contingencies of Notes to the Financial Statements.

In 2011, we recognized a charge of $240 million for environmental liabilities deemed probable and

reasonably estimable during the year. We recognized asbestos related litigation charges, net of

insurance, of $149 million.

In 2010, we recognized a charge of $212 million for environmental liabilities deemed probable and

reasonably estimable during the year. We recognized asbestos related litigation charges, net of

insurance, of $175 million. We also recognized other charges of $62 million in connection with the

evaluation of potential resolution of certain legal matters.

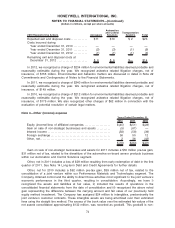

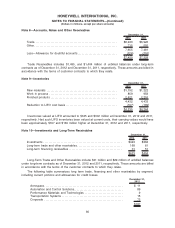

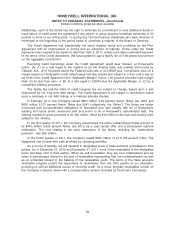

Note 4—Other (income) expense

2012 2011 2010

Years Ended December 31,

Equity (income)/loss of affiliated companies. . . . . . . . . . . . . . . . . . . . $(45) $(51) $(28)

Gain on sale of non-strategic businesses and assets . . . . . . . . . . (5) (61) —

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (58) (58) (39)

Foreign exchange . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36 50 12

Other, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 36 (42)

$(70) $(84) $(97)

Gain on sale of non-strategic businesses and assets for 2011 includes a $50 million pre-tax gain,

$31 million net of tax, related to the divestiture of the automotive on-board sensor products business

within our Automation and Control Solutions segment.

Other, net in 2011 includes a loss of $29 million resulting from early redemption of debt in the first

quarter of 2011. See Note 14 Long-term Debt and Credit Agreements for further details.

Other, net for 2010 includes a $62 million pre-tax gain, $39 million net of tax, related to the

consolidation of a joint venture within our Performance Materials and Technologies segment. The

Company obtained control and the ability to direct those activities most significant to the joint venture’s

economic performance in the third quarter, resulting in consolidation. Accordingly, we have i)

recognized the assets and liabilities at fair value, ii) included the results of operations in the

consolidated financial statements from the date of consolidation and iii) recognized the above noted

gain representing the difference between the carrying amount and fair value of our previously held

equity method investment. The Company has assigned $24 million to intangibles, predominantly the

joint venture’s customer contracts. These intangible assets are being amortized over their estimated

lives using the straight line method. The excess of the book value over the estimated fair values of the

net assets consolidated approximating $132 million, was recorded as goodwill. This goodwill is non-

74

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)