Honeywell 2012 Annual Report Download - page 78

Download and view the complete annual report

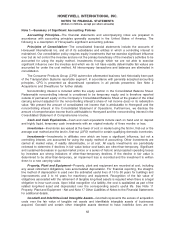

Please find page 78 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.approximately $331 million (including the assumption of debt of $33 million) and was allocated to

tangible and identifiable intangible assets acquired and liabilities assumed based on their estimated fair

values at the acquisition date. The Company has assigned approximately $167 million to identifiable

intangible assets, predominantly trademarks, technology, and customer relationships. The definite lived

intangible assets are being amortized over their estimated lives, using straight-line and accelerated

amortization methods. The value assigned to trademarks of approximately $84 million is classified as

indefinite lived intangibles. The excess of the purchase price over the estimated fair values of net

assets acquired (approximately $157 million), was recorded as goodwill. This goodwill arises primarily

from the avoidance of the time and costs which would be required (and the associated risks that would

be encountered) to enhance our product offerings to key target markets and serve as entry into new

and profitable segments, and the expected cost synergies that will be realized through the

consolidation of the acquired business into our Automation and Control Solutions segment. Their

cost synergies are expected to be realized principally in the areas of selling, general and administrative

expenses, material sourcing and manufacturing. This goodwill is non—deductible for tax purposes.

The results from the acquisition date through December 31, 2011 are included in the Automation

and Control Solutions segment and were not material to the consolidated financial statements.

In August 2011, the Company acquired 100 percent of the issued and outstanding shares of EMS

Technologies, Inc. (EMS), a leading provider of connectivity solutions for mobile networking, rugged

mobile computers and satellite communications. EMS had reported 2010 revenues of approximately

$355 million.

The aggregate value, net of cash acquired, was approximately $513 million and was allocated to

tangible and identifiable intangible assets acquired and liabilities assumed based on their estimated fair

values at the acquisition date. The Company has assigned approximately $119 million to identifiable

intangible assets, of which approximately $89 million and approximately $30 million were recorded

within the Aerospace and Automation and Control segments, respectively. The intangible assets are

predominantly customer relationships, existing technology and trademarks. These intangible assets are

being amortized over their estimated lives, using straight-line and accelerated amortization methods.

The excess of the purchase price over the estimated fair values of net assets acquired (approximating

$314 million), was recorded as goodwill. This goodwill arises primarily from the avoidance of the time

and costs which would be required (and the associated risks that would be encountered) to enhance

our product offerings to key target markets and serve as entry into new and profitable segments, and

the expected cost synergies that will be realized through the consolidation of the acquired business

into our Aerospace and Automation and Control Solutions segments. These cost synergies are

expected to be realized principally in the areas of selling, general and administrative expenses,

material sourcing and manufacturing. This goodwill is non-deductible for tax purposes.

The results from the acquisition date through December 31, 2011 are included in the Aerospace

and Automation and Control Solutions segments and were not material to the consolidated financial

statements.

In October 2010, we completed the acquisition of the issued and outstanding shares of Sperian

Protection (Sperian), a French company that operates globally in the personal protection equipment

design and manufacturing industry. Sperian had reported 2009 revenues of approximately $900 million.

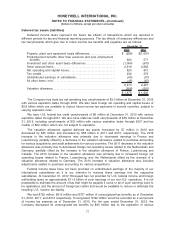

The aggregate value, net of cash acquired, was approximately $1,475 million (including the

assumption of approximately $326 million of outstanding debt) and was allocated to tangible and

identifiable intangible assets acquired and liabilities assumed based on their estimated fair values at

the acquisition date.

The following amounts represent the final determination of the fair value of the identifiable assets

acquired and liabilities assumed.

69

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)