Honeywell 2012 Annual Report Download - page 48

Download and view the complete annual report

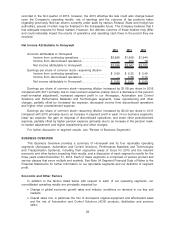

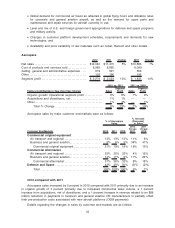

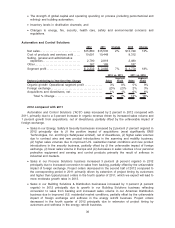

Please find page 48 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•UOP sales increased by 17 percent (12 percent organic) in 2012 compared to 2011 primarily

driven by (i) increased equipment and licensing revenues and higher volume of petrochemical

and refining catalysts in the first nine months, reflecting continued strength in the refining and

petrochemical industries, and (ii) the favorable impact from acquisitions, partially offset by lower

service revenue related to scheduled project completions.

•Advanced Materials sales increased by 5 percent (flat organic) in 2012 compared to 2011

primarily driven by an increase in Resins and Chemicals sales, primarily due to the phenol plant

acquisition; offset by lower sales in Fluorine Products primarily due to unfavorable pricing

reflecting more challenging global end market conditions and the unfavorable impact of foreign

exchange. We expect challenging global end market conditions to continue in the first quarter of

2013.

PMT segment profit increased by 11 percent in 2012 compared with 2011 due to a 9 percent

increase in operational segment profit (net of a 10 percent decrease in the fourth quarter due to the

factors described below) and a 3 percent increase from acquisitions partially offset by an unfavorable

impact of 1 percent in foreign exchange. The increase in operational segment profit is primarily due to

higher licensing, catalyst and equipment revenues in UOP and productivity (net of continued

investment in growth initiatives) partially offset by unfavorable pricing in Fluorine Products and Resins

and Chemicals reflecting more challenging global end market conditions. Cost of products and services

sold totaled $4.5 billion in 2012, an increase of $392 million which is primarily due to acquisitions,

higher volume and continued investment in growth initiatives partially offset by productivity and the

favorable impact of foreign exchange.

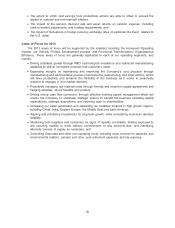

In July 2012, the Company announced that it is evaluating a series of upgrades to its Metropolis

Works nuclear conversion facility, a Fluorine Products facility, following a U.S. Nuclear Regulatory

Commission (NRC) inspection that focused on preparedness for extreme natural disasters such as

strong earthquakes and tornados. The NRC inspection was part of a comprehensive assessment of all

U.S. nuclear-related facilities following the Fukushima, Japan earthquake in 2011. Production at the

Metropolis facility was suspended following the NRC inspection and will not resume until certain

seismic-related upgrades have been implemented by the Company and reviewed by the NRC. The

scope of these upgrades has been defined in a Confirmatory Order issued by the NRC to Honeywell

on October 16, 2012. The Company believes that completion of the upgrades to the facility could be

completed by the third quarter of 2013. The continued suspension of operations and the cost of the

plant upgrades are not expected to have a material negative impact on Performance Materials and

Technologies’ 2013 results of operations.

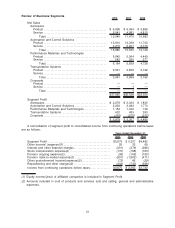

2011 compared with 2010

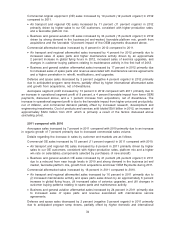

PMT sales increased by 20 percent in 2011 compared with 2010 due to a 16 percent increase in

organic growth, 3 percent growth from acquisitions, and a 1 percent favorable impact of foreign

exchange.

•UOP sales increased by 24 percent in 2011 compared to 2010 primarily driven by increased

service, and licensing revenues and higher unit sales of refining and specialty catalysts,

primarily reflecting continued strength in the refining and petrochemical industries.

•Advanced Materials sales increased by 18 percent (12 percent organically) in 2011 compared to

2010 primarily driven by (i) a 33 percent (18 percent organically) increase in Resins and

Chemicals sales primarily due to higher prices driven by strong Asia demand, agricultural

demand, formula pricing arrangements and increased sales resulting from the acquisition of a

phenol plant, partially offset by decreased volumes primarily due to disruptions in phenol supply

and weather related events, (ii) a 10 percent increase in our Fluorine Products business due to

higher pricing reflecting robust global demand and tight industry supply conditions primarily in

the first half of the year, which moderated in the second half of the year due to seasonally

weaker demand and increased available capacity in the marketplace, and (iii) a 12 percent

increase in Specialty Products sales primarily due to higher sales volume in our armor,

additives, and healthcare packaging products, and commercial excellence initiatives. We expect

Advanced Materials sales growth to continue to moderate during the first half of 2012 due to

39