Honeywell 2012 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

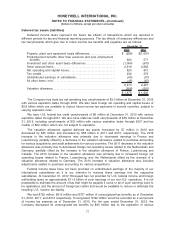

statute of limitations and settlements with tax authorities, partially offset by adjustments related to our

ongoing assessment of the likelihood and amount of potential outcomes of current and future

examinations. For the year ended December 31, 2011, the Company increased its unrecognized tax

benefits by $58 million due to additional reserves for various international and U.S. tax audit matters,

partially offset by adjustments related to our ongoing assessment of the likelihood and amount of

potential outcomes of current and future examinations, the expiration of various statute of limitations,

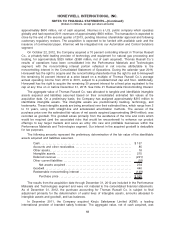

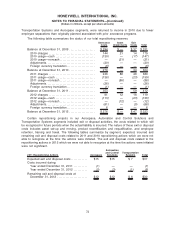

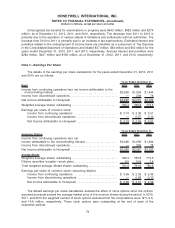

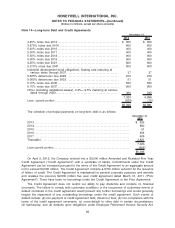

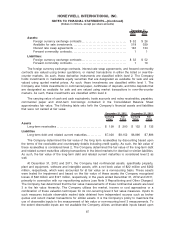

and settlements with tax authorities. The following table summarizes the activity related to our

unrecognized tax benefits:

2012 2011 2010

Change in unrecognized tax benefits:

Balance at beginning of year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $815 $ 757 $720

Gross increases related to current period tax positions . . . . . . . . . . 25 46 37

Gross increases related to prior periods tax positions . . . . . . . . . . . 44 327 84

Gross decreases related to prior periods tax positions. . . . . . . . . . . (62) (56) (41)

Decrease related to settlements with tax authorities . . . . . . . . . . . . . (40) (237) (23)

Expiration of the statute of limitations for the assessment of

taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (64) (12) (8)

Foreign currency translation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 (10) (12)

Balance at end of year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $722 $ 815 $757

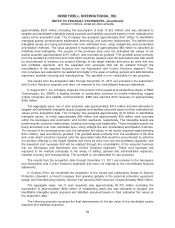

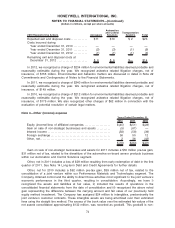

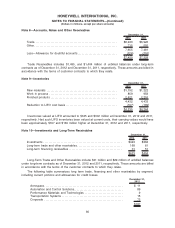

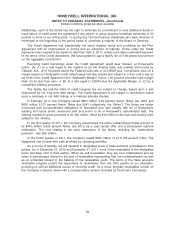

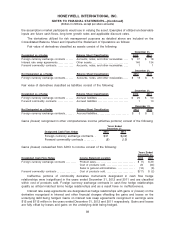

Generally, our uncertain tax positions are related to tax years that remain subject to examination

by the relevant tax authorities. The following table summarizes these open tax years by major

jurisdiction as of December 31, 2012:

Jurisdiction

Examination in

progress

Examination not yet

initiated

Open Tax Year

United States(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . 2001 – 2011 2005 – 2012

United Kingdom . . . . . . . . . . . . . . . . . . . . . . . . . . . N/A 2011 – 2012

Canada(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2006 – 2010 2011 – 2012

Germany(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2004 – 2009 2010 – 2012

France . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2009 – 2011 2000 – 2008, 2012

Netherlands . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2009 2010 – 2012

Australia . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . N/A 2009 – 2012

China . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2009 – 2010 2006 – 2008, 2011 – 2012

India . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2000—2010 2011 – 2012

Italy. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2005 – 2011 2012

(1) Includes federal as well as state, provincial or similar local jurisdictions, as applicable.

Based on the outcome of these examinations, or as a result of the expiration of statute of

limitations for specific jurisdictions, it is reasonably possible that certain unrecognized tax benefits for

tax positions taken on previously filed tax returns will materially change from those recorded as

liabilities for uncertain tax positions in our financial statements. In addition, the outcome of these

examinations may impact the valuation of certain deferred tax assets (such as net operating losses) in

future periods. Based on the number of tax years currently under audit by the relevant U.S federal,

state and foreign tax authorities, the Company anticipates that several of these audits may be finalized

in the foreseeable future. However, based on the status of these examinations, the protocol of

finalizing audits by the relevant taxing authorities, and the possibility that the Company might challenge

certain audit findings (which could include formal legal proceedings), at this time it is not possible to

estimate the impact of such changes, if any, to previously recorded uncertain tax positions.

78

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)