Honeywell 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Part II.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters

and Issuer Purchases of Equity Securities

Honeywell’s common stock is listed on the New York Stock Exchange. Market and dividend

information for Honeywell’s common stock is included in Note 27 Unaudited Quarterly Financial

Information of Notes to Financial Statements in “Item 8. Financial Statements and Supplementary

Data.”

The number of record holders of our common stock at December 31, 2012 was 55,879.

Honeywell purchased 5,000,000 shares of its common stock, par value $1 per share, in the

quarter and year ending December 31, 2012. Under the Company’s previously reported $3 billion

share repurchase program, $1.6 billion remained available as of December 31, 2012 for additional

share repurchases. Honeywell presently expects to repurchase outstanding shares from time to time

during 2013 to offset the dilutive impact of employee stock based compensation plans, including future

option exercises, restricted unit vesting and matching contributions under our savings plans. The

amount and timing of future repurchases may vary depending on market conditions and the level of

operating, financing and other investing activities.

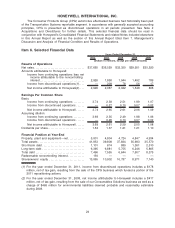

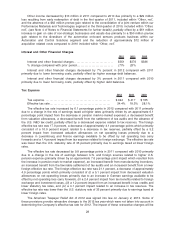

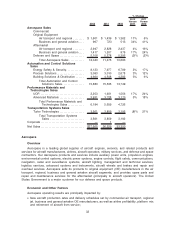

The following table summarizes Honeywell’s purchase of its common stock, par value $1 per

share, for the three months ended December 31, 2012:

Issuer Purchases of Equity Securities

Period

Total

Number of

Shares

Purchased

Average

Price Paid

per Share

Total Number

of Shares

Purchased as

Part of Publicly

Announced

Plans

or Programs

Approximate Dollar

Value of Shares that

May Yet be Purchased

Under Plans or

Programs

(Dollars in millions)

(a) (b) (c) (d)

December 2012 5,000,000 $63.31 5,000,000 $1,598

22