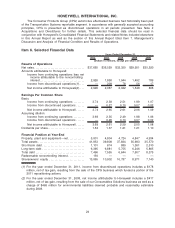

Honeywell 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•Capital expenditures grew 11 percent to $884 million including the construction or expansion of

technology centers in India and Saudi Arabia.

•The Company recognized approximately $119 million of restructuring actions to support

sustainable productivity in years to come.

•The Company completed $438 million (net of cash acquired) in acquisitions in 2012, including

acquisition of a 70 percent ownership interest in Thomas Russell L.L.C. (“Thomas Russell Co.”),

a leader in technology and equipment for natural gas processing and treating, primarily serving

the US market.

•Expansion of Honeywell’s presence and sales in high growth regions and countries such as

China, India, Eastern Europe, the Middle-East, and Latin America. Sales to customers outside

the United States now account for approximately 55 percent of total revenues.

Operating cash flow grew by 24 percent in 2012 to $3,517 million. This operating cash flow

performance enabled us to invest $884 million in capital expenditures, fund the acquisitions discussed

above, make $1,039 million in pension contributions, and provide an 11 percent increase in dividends

paid (vs. 2011) and repurchase 5 million shares of common stock.

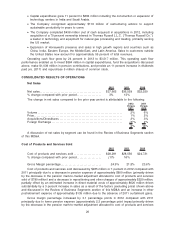

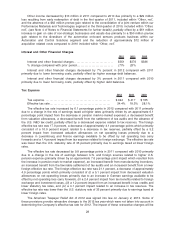

CONSOLIDATED RESULTS OF OPERATIONS

Net Sales

2012 2011 2010

Net sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $37,665 $36,529 $32,350

% change compared with prior period. . . . . . . . . . . . . . . . . . 3% 13%

The change in net sales compared to the prior year period is attributable to the following:

2012

Versus

2011

2011

Versus

2010

Volume . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2% 6%

Price. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1% 2%

Acquisitions/Divestitures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2% 3%

Foreign Exchange . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2)% 2%

3% 13%

A discussion of net sales by segment can be found in the Review of Business Segments section

of this MD&A.

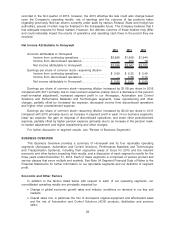

Cost of Products and Services Sold

2012 2011 2010

Cost of products and services sold . . . . . . . . . . . . . . . . . . . . $28,291 $28,556 $24,721

% change compared with prior period. . . . . . . . . . . . . . . . . . (1)% 16%

Gross Margin percentage. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24.9% 21.8% 23.6%

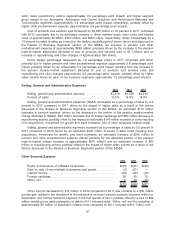

Cost of products and services sold decreased by $265 million or 1 percent in 2012 compared with

2011 principally due to a decrease in pension expense of approximately $800 million (primarily driven

by the decrease in the pension mark-to-market adjustment allocated to cost of products and services

sold of $780 million) and a decrease in repositioning and other charges of approximately $220 million,

partially offset by an estimated increase in direct material costs of approximately $620 million driven

substantially by a 3 percent increase in sales as a result of the factors (excluding price) shown above

and discussed in the Review of Business Segments section of this MD&A and an increase in other

postretirement expense of approximately $135 million due to the absence of 2011 curtailment gains.

Gross margin percentage increased by 3.1 percentage points in 2012 compared with 2011

principally due to lower pension expense (approximately 2.2 percentage point impact primarily driven

by the decrease in the pension mark-to-market adjustment allocated to cost of products and services

26