Honeywell 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

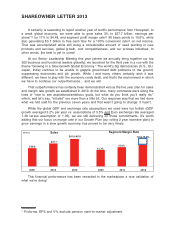

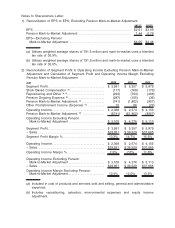

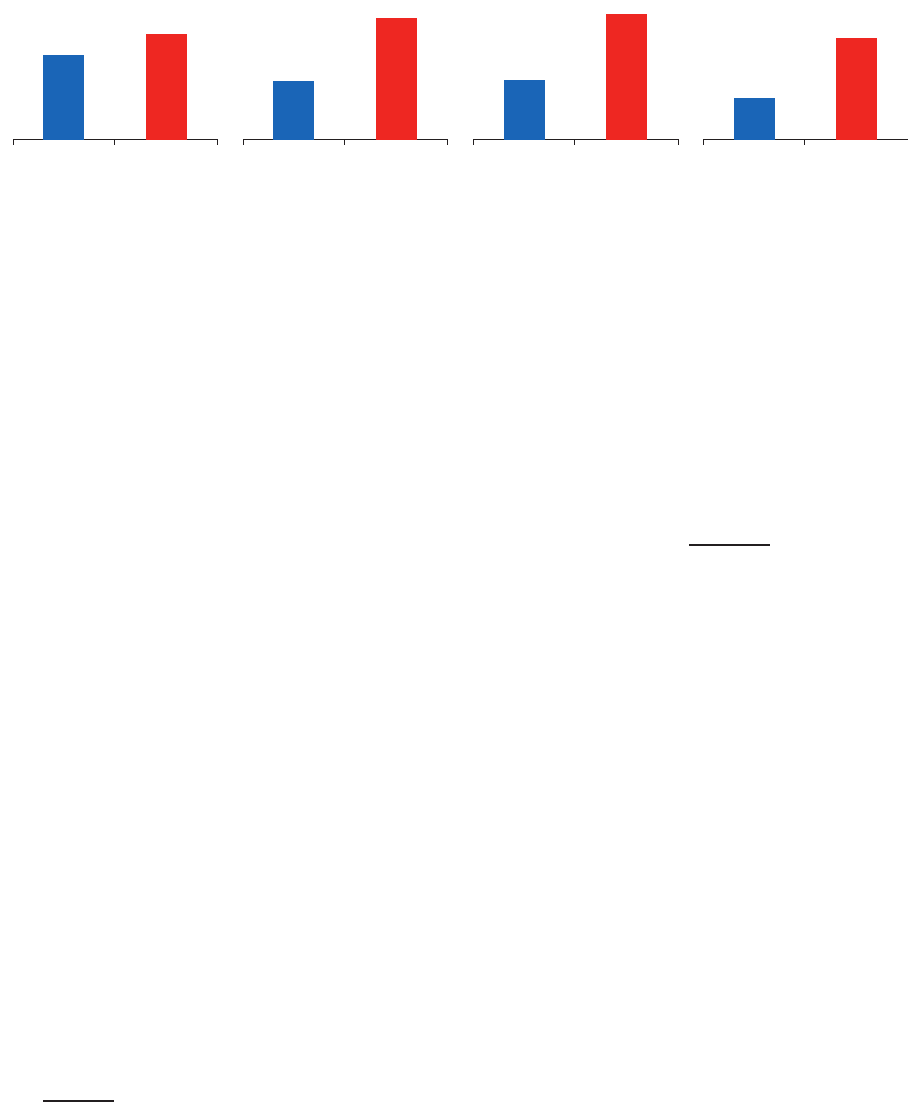

Honeywell vs S&P 500

16%

20%

Honeywell

1 YEAR

S&P 500

36%

75%

Honeywell

3 YEAR

S&P 500

9%

19%

Honeywell

5 YEAR

S&P 500

99%

240%

Honeywell

10 YEAR

S&P 500

We’re proud of our historical performance of course, but more importantly we’re excited

about the future. I’ve talked in past letters about how evolution will continue in everything we

do. We have an incredible opportunity to get better in everything… and we can see it.

At the 2014 Investor Conference, we plan to issue a new five-year plan. We won’t be

updating the current five-year plan, despite numerous requests, because I don’t want to be

dealing with shifting goal posts. It should add to the credibility of the new five year plan when

we can show what we accomplished in the previous plan even under tougher conditions.

So why have we performed and why is it believable that outperformance will continue?

I’d break it into three areas… Portfolio, Culture, and Internal Processes.

Great Positions in Good Industries has been a huge driver of our Portfolio development.

Over the past ten years we’ve added about $10 billion in sales through acquisitions and

divested about $6 billion. Those 125 or so transactions have significantly changed the growth

profile of the company.

We’ve positioned ourselves well within strong macro-trends like expanding global wealth

per capita, energy efficiency, energy generation, safety and security, urbanization, and the

need for productivity. Having a good sustainable growth portfolio also is demonstrated in

what’s avoided. While we focus on technology differentiation everywhere, we avoid industries

where rapid technology change can completely displace you in one product introduction. We

also avoid industries heavily reliant on government tax support.

“Diversity of Opportunity” significantly enhances our growth prospects because there is

never any one product, geography, industry, or business that “makes” our company. By the

same token, being wrong about any one of those never kills us either. By having lots of bets

in a number of great areas there is always enough going really well to propel us to

outperformance. Our Transportation Systems business is a great example. They had a

horrible year financially, principally because of European economic troubles, but a great year

strategically. Turbos in particular is a wonderful industry and we were able to win about 50%

of all worldwide orders on a dollar basis and invest in terrific new technologies for the future.

Diversity of Opportunity works.

Culture is just as important. As we often say, “the trick is in the doing.” There is a big

difference between compliance with words and compliance with intent. The manuals for new

product introduction, customer service and management resource reviews probably look

pretty much the same from company to company. It’s more a matter of how well you do it.

Our One Honeywell culture has evolved rapidly from a base ten years ago of three very

different cultures from predecessor companies. We continue to evolve in our Twelve

Behaviors capability. We are developing a “thinking company.” Not thinking as in spending

days in contemplation or thinking as in anarchy so you don’t have to do what’s requested, but

rather thinking as in understanding why we do things. That concept underlies our big process