Honeywell 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•The extent to which cost savings from productivity actions are able to offset or exceed the

impact of material and non-material inflation;

•The impact of the pension discount rate and asset returns on pension expense, including

mark-to-market adjustments, and funding requirements; and

•The impact of fluctuations in foreign currency exchange rates (in particular the Euro), relative to

the U.S. dollar.

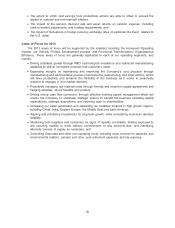

Areas of Focus for 2013

The 2013 areas of focus will be supported by the enablers including the Honeywell Operating

System, our Velocity Product Development process, and Functional Transformation/ Organizational

Efficiency. These areas of focus are generally applicable to each of our operating segments, and

include:

•Driving profitable growth through R&D, technological excellence and optimized manufacturing

capability to deliver innovative products that customers value;

•Expanding margins by maintaining and improving the Company’s cost structure through

manufacturing and administrative process improvements, restructuring, and other actions, which

will drive productivity and enhance the flexibility of the business as it works to proactively

respond to changes in end market demand;

•Proactively managing raw material costs through formula and long-term supply agreements and

hedging activities, where feasible and prudent;

•Driving strong cash flow conversion through effective working capital management which will

enable the Company to undertake strategic actions to benefit the business including capital

expenditures, strategic acquisitions, and returning cash to shareholders;

•Increasing our sales penetration and expanding our localized footprint in high growth regions,

including China, India, Eastern Europe, the Middle East and Latin America;

•Aligning and prioritizing investments for long-term growth, while considering short-term demand

volatility;

•Monitoring both suppliers and customers for signs of liquidity constraints, limiting exposure to

any resulting inability to meet delivery commitments or pay amounts due, and identifying

alternate sources of supply as necessary; and

•Controlling Corporate and other non-operating costs, including costs incurred for asbestos and

environmental matters, pension and other post-retirement expenses and tax expense.

30