Honeywell 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

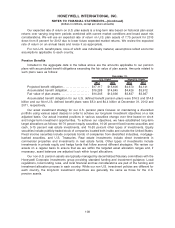

Our expected rate of return on U.S. plan assets is a long-term rate based on historical plan asset

returns over varying long-term periods combined with current market conditions and broad asset mix

considerations. We will use an expected rate of return on U.S. plan assets of 7.75 percent for 2013

down from 8 percent for 2012 due to lower future expected market returns. We review the expected

rate of return on an annual basis and revise it as appropriate.

For non-U.S. benefit plans, none of which was individually material, assumptions reflect economic

assumptions applicable to each country.

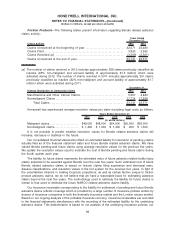

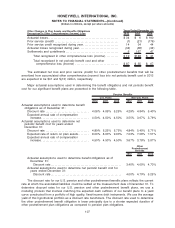

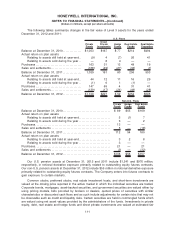

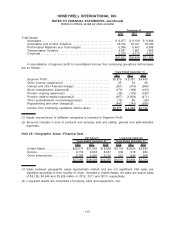

Pension Benefits

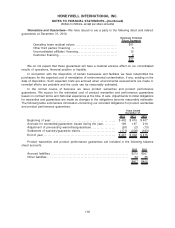

Included in the aggregate data in the tables above are the amounts applicable to our pension

plans with accumulated benefit obligations exceeding the fair value of plan assets. Amounts related to

such plans were as follows:

2012 2011 2012 2011

U.S. Plans Non-U.S. Plans

December 31,

Projected benefit obligation . . . . . . . . . . . . . . . . . . . $17,117 $15,600 $4,670 $4,141

Accumulated benefit obligation. . . . . . . . . . . . . . . . $16,288 $14,845 $4,426 $3,912

Fair value of plan assets . . . . . . . . . . . . . . . . . . . . . $14,345 $12,836 $3,837 $3,367

Accumulated benefit obligation for our U.S. defined benefit pension plans were $16.3 and $14.8

billion and our Non-U.S. defined benefit plans were $5.0 and $4.4 billion at December 31, 2012 and

2011, respectively.

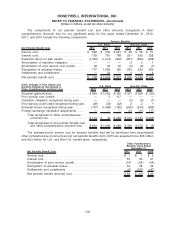

Our asset investment strategy for our U.S. pension plans focuses on maintaining a diversified

portfolio using various asset classes in order to achieve our long-term investment objectives on a risk

adjusted basis. Our actual invested positions in various securities change over time based on short

and longer-term investment opportunities. To achieve our objectives, we have established long-term

target allocations as follows: 60-70 percent equity securities, 10-20 percent fixed income securities and

cash, 5-15 percent real estate investments, and 10-20 percent other types of investments. Equity

securities include publicly-traded stock of companies located both inside and outside the United States.

Fixed income securities include corporate bonds of companies from diversified industries, mortgage-

backed securities, and U.S. Treasuries. Real estate investments include direct investments in

commercial properties and investments in real estate funds. Other types of investments include

investments in private equity and hedge funds that follow several different strategies. We review our

assets on a regular basis to ensure that we are within the targeted asset allocation ranges and, if

necessary, asset balances are adjusted back within target allocations.

Our non-U.S. pension assets are typically managed by decentralized fiduciary committees with the

Honeywell Corporate Investments group providing standard funding and investment guidance. Local

regulations, local funding rules, and local financial and tax considerations are part of the funding and

investment allocation process in each country. While our non-U.S. investment policies are different for

each country, the long-term investment objectives are generally the same as those for the U.S.

pension assets.

108

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)