Honeywell 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141

|

|

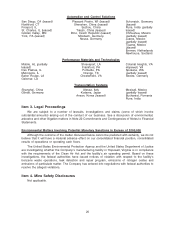

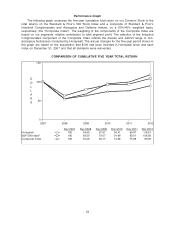

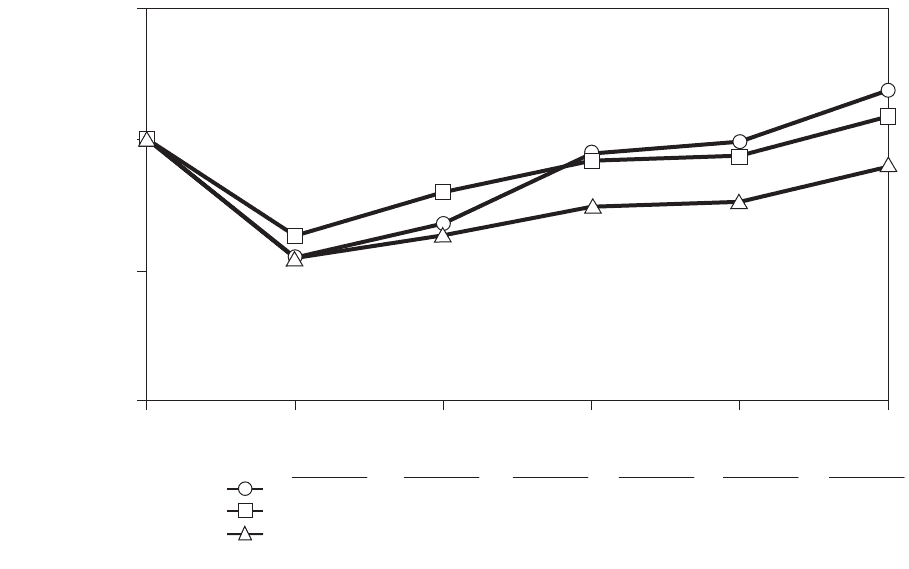

Performance Graph

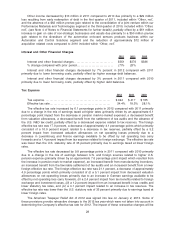

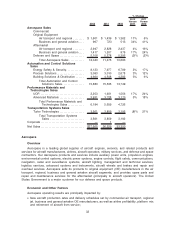

The following graph compares the five-year cumulative total return on our Common Stock to the

total returns on the Standard & Poor’s 500 Stock Index and a composite of Standard & Poor’s

Industrial Conglomerates and Aerospace and Defense indices, on a 60%/40% weighted basis,

respectively (the “Composite Index”). The weighting of the components of the Composite Index are

based on our segments’ relative contribution to total segment profit. The selection of the Industrial

Conglomerates component of the Composite Index reflects the diverse and distinct range of non-

aerospace businesses conducted by Honeywell. The annual changes for the five-year period shown in

the graph are based on the assumption that $100 had been invested in Honeywell stock and each

index on December 31, 2007 and that all dividends were reinvested.

COMPARISON OF CUMULATIVE FIVE YEAR TOTAL RETURN

D

O

L

L

A

R

S

0

50

100

150

2011 20122010200920082007

Dec 2007 Dec 2008 Dec 2009 Dec 2010 Dec 2011 Dec 2012

Honeywell 100 54.65 67.67 94.41 98.97 118.61

S&P 500 Index® 100 63.00 79.67 91.68 93.61 108.59

Composite Index 100 54.48 63.17 74.08 75.96 89.39

23