Experian 2012 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 Experian Annual Report 2012 Governance

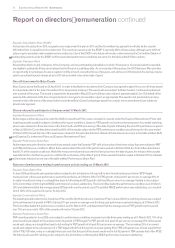

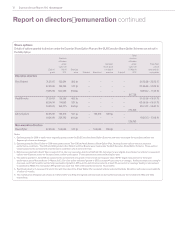

Experian Share Option Plan (‘ESOP’)

As has been the policy from 2010, no grants were made under this plan in 2011 and the Committee has agreed this will also be the case for

2012 (other than in exceptional circumstances). The maximum award under the ESOP is normally 200% of base salary, although up to 400% of

salary may be awarded under exceptional circumstances. Use of the ESOP in the future will remain under review by the Committee. Details of

outstanding awards under the ESOP and the associated performance conditions are set out in the table entitled ‘Share options’.

Experian Sharesave Plans

All executive directors and employees of the Company, and any participating subsidiaries in which Sharesave or a local equivalent is operated,

are eligible to participate if they are employed by the Group at a qualifying date. As an example of these plans, the UK Sharesave Plan provides

an opportunity for employees to save a regular monthly amount, over either three or five years, and, at the end of that period, the savings may be

used to purchase Experian shares at up to 20% below market value at the date of grant.

One-off share award to Brian Cassin

Brian Cassin joined the Board on 30 April 2012. In order to facilitate his recruitment, the Company has agreed to grant him a one-off share award

to compensate him for the loss of incentives from his previous employer. The award will vest, subject to Brian Cassin’s continued employment,

over a period of five years. The award is expected to be granted in May 2012 and will have a face value of approximately £1.3m. Full details of the

award will be disclosed at the time it is granted and in next year’s remuneration report, as appropriate. The award is not pensionable and any

amendments to the terms of the award which would be to Brian Cassin’s advantage (apart from certain minor amendments) are subject to

shareholder approval.

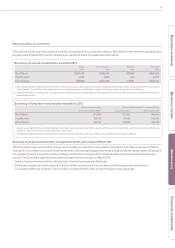

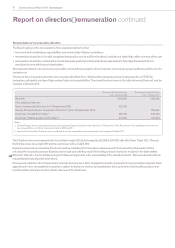

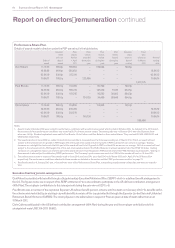

Shares released to participants in the year ended 31 March 2012

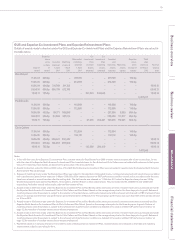

Experian Reinvestment Plans

At demerger, outstanding awards under the GUS Co-investment Plans were reinvested in awards under the Experian Reinvestment Plans with

matching awards available subject to further performance conditions, based on PBT growth and continued employment. Any vested matching

shares were released in three tranches on the third, fourth and fifth anniversary of the date of grant. Following the end of the performance period

in March 2009, the Committee determined that 92% of the awards subject to the PBT performance condition would vest and in the year ended

31 March 2012, the last tranche of the award was released to the executive directors. Details of these shares are set out in the table entitled ‘GUS

and Experian Co-investment Plans and Experian Reinvestment Plans’.

Experian Performance Share Plan

At demerger, executive directors received share awards under the Experian PSP with a face value of two times salary that were subject to PBT

and TSR performance conditions. When these were tested at the end of the performance period in October 2009, the Committee determined

that 80.7% of the awards would vest. Whilst the measurement period was over the three years from the date of grant, the release of the awards

was deferred for a further two years (i.e. until the 5th anniversary of the date of grant). These awards therefore vested in October 2011 and details

of the shares released are set out in the table entitled ‘Performance Share Plan’.

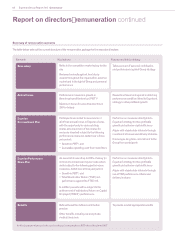

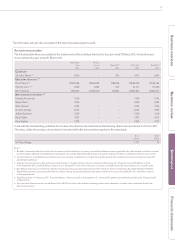

Outcome of performance testing for performance periods ending on 31 March 2012

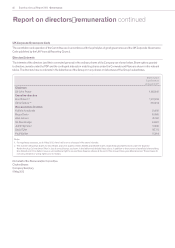

Experian Share Option Plan

In June 2009 participants were granted options subject to the achievement of a growth in benchmark earnings per share (‘EPS’) target

measured over a three-year performance period that ended as at 31 March 2012. For EPS growth of at least 4% per annum on average 25% of

an option would vest, rising on a straight-line basis to full vesting for EPS growth of at least 8% per annum on average. Vesting is also subject

to the Committee confirming that ROCE performance has been satisfactory. The Committee tested the performance condition as at 31 March

2012 and determined that the average annual EPS growth over the period was 9.7% and that ROCE performance was satisfactory, as a result of

which 100% of the awards will vest on 18 June 2012.

Experian Co-investment Plans

For awards granted under the Co-investment Plan and the North America Co-investment Plan in June 2009, the matching shares were subject

to the achievement of growth in PBT of at least 3% per annum on average over the three-year performance period ending as at 31 March 2012.

The Committee tested this performance condition as at 31 March 2012 and determined that the average annual PBT growth over the period

was 12% and as a result, 100% of the awards will vest on 18 June 2012.

Experian Performance Share Plan

PSP awards granted in June 2009 were subject to performance conditions measured over the three years ending as at 31 March 2012. 75% of an

award would vest subject to the achievement of a growth in PBT target. For PBT growth of at least 4% per annum on average 25% of the award

would vest, rising on a straight-line basis to full vesting for PBT growth of at least 8% per annum on average. The remaining 25% of an award

would vest subject to the achievement of a TSR target with 25% of this part of an award vesting if the TSR of Experian was at least equal to that

of the FTSE 100 Index, rising on a straight-line basis such that this part of the award would vest in full if Experian’s TSR exceeds that of the FTSE

100 Index by at least 25%. Vesting is also subject to the Committee confirming that ROCE performance has been satisfactory.

Report on directors’ remuneration continued

P78

P80

P79